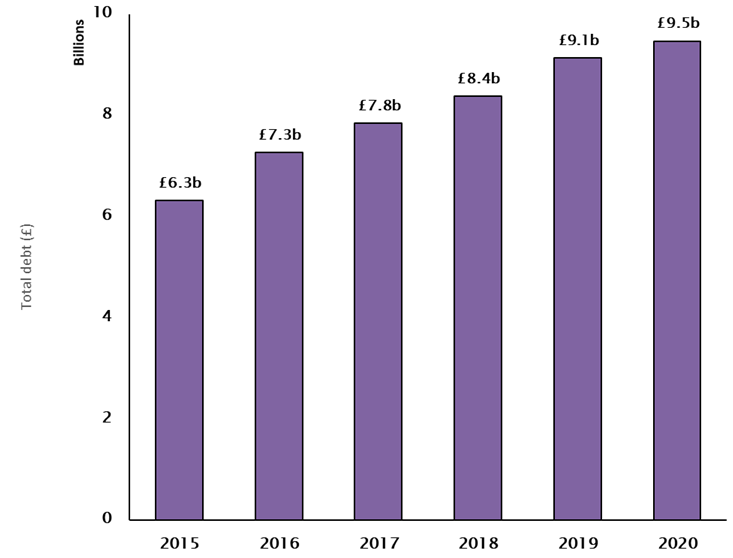

UK universities’ debt burden grows 50% in five years

The debt burden of the UK’s 20 largest universities by student population has increased 50% from £6.3bn to £9.5bn over the last five years* says New Street Consulting Group (@NSConsultGroup), the leadership and people solutions consultancy.

New Street Consulting Group says this rise in debt is due predominantly to major new infrastructure projects by the largest universities. This includes the buying and building of properties to be used for student accommodation.

The firm says universities are also under pressure from growing student populations to build more retail and leisure spaces on campus and enhance the overall student experience of university. The Covid-19 pandemic has sharply impacted the revenues universities have been able to generate from these operations, putting debt repayments under further pressure.

Student numbers in the UK in 2019/2020 rose 3.2% to 2.46 million in the UK**. This has led greater demand for accommodation and student services, with universities investing heavily in these areas and having to increase their borrowing to do so.

The effects of the pandemic have caused financial difficulties for some universities. This has led to cost-cutting by a number of universities as they prepare for an expected rise in drop-out numbers and a fall in the number of overseas students.

New Street Consulting Group says hiring interim finance directors is crucial for the higher education sector to manage debts in the short and medium term. Talent from the private sector with experience of managing highly-leveraged businesses could help secure the long-term financial security of universities. Bringing on board senior talent with expertise in cost management for large organisations could also benefit universities.

New Street Consulting Group says some universities should also look at hiring senior talent from the leisure and retail sectors to help manage their new social and retail projects on campus to ensure they maximise the return on their substantial investment in these facilities. Running these operations as a profit-generating business is particularly challenging in a post-Covid landscape, making experience in challenging economies particularly valuable.

Scott Hutchinson, Principal Consultant of Education at New Street Consulting Group, says, “This has been a particularly difficult year for universities – the coronavirus pandemic could not have come at a worse time as their debt burdens grow.”

“Major universities have become very large, complex and leveraged organisations over the last 20 years. They now need to ensure that their senior leaders have the right mix of skills and experience to run a business of that kind effectively. Looking outside the higher education sector for talent is now a step all universities should be taking.”

“Expanding their social and retail offerings mean that universities are competing with other social and retail destinations. That requires a very different skillset than most university management teams will have. Bringing in senior talent from the retail, leisure and real estate sectors should be part of the plan for more universities.”

* Source: Top 20 universities by student population; sum of amounts owed to creditors due within less than one year and after more than one year. Amounts due within less than one year have risen from £3.3bn in 2015 to £4.2bn in 2020. These figures comprise a range of costs including trade payables, grants not yet paid to researchers and bank overdrafts. Amounts due after more than one year have risen from £3bn in 2015 to £5.2bn in 2020 and primarily comprise secured and unsecured loans and other long-term finance.

** House of Commons Briefing Paper: Higher Education Student Numbers, Feb 2021

Responses