Time for new AI to digitally transform the Metaverse to improve safety says Guildhawk director

My Guildhawk Voice avatar was in Jersey last week speaking at the School of International Financial Services (SIFS) 2021 Economic Crime & Compliance Symposium, communicating in English and Spanish. Why was he there, and equally, why did I escape Zoomland and travel to be at this physical event?

Demonstrating the power of the latest multilingual Artificial Intelligence technologies was one reason. AI like this can digitally transform (DX) a company and keep people safe by making sure vital messages are understood by millions of people in over 50 languages rather than only being heard by those who speak English. Guildhawk’s multilingual avatars are just one of the features in the new, immersive world of physical and virtual interactions known as the Metaverse – and it’s going to change your life.

International corporate firms spend huge sums of money on policies and wizzy e-learning packages as part of their Reasonable Prevention Procedures regime. These are to protect them and their people from allegations of wrongdoing. However, many firms are at risk of falling foul of the law. Telling staff in English how they can stop the company inadvertently downloading ransomware, getting into bed with money launders or being prosecuted by HMRC for the criminal offence of failing to prevent tax evasion, is a risk in itself if the person being trained doesn’t speak English well.

Helen Hatton, the charismatic Director of SIFS knows a thing or two about keeping nations and businesses safe, and is widely recognized as the prime architect of the modern Jersey regulatory regime. She invited me to attend the symposium on behalf of the Fraud Advisory Panel charity and tell delegates in person about the types of fraud we have seen. My avatar gave a snapshot of the many activities our COVID-19 Fraud Watch and team at the charity has done during the pandemic. Friends say my avatar is far better to listen to than the real me.

Harsh as this seems, they have a point!

It is exciting to see new developments that will make Guildhawk Voice avatars even more immersive and able to interact with humans to keep people safe on construction sites, in the office, home, out at sea or up in space for that matter. These disruptive innovations are possible because of two things – brilliant people writing beautiful code, and AI that is trained and uses an ultra-pure multilingual data lake that we have created over the past 8 years.

When these new products arrive, people will find they can easily live and operate easily between the real and virtual worlds in the Metaverse. In this space you may choose to be yourself in a Microsoft Teams meeting or decide to be seen as a cartoon character, whatever is considered appropriate.

For the SIFS, it was appropriate to be there in person and that provided a great opportunity to finally meet various experts and listen to them in the physical world. I was very interested to meet HMRC Directors Simon York CBE and Samuel Dean who spoke about fraud investigations, the criminal offence of failing to prevent and powers it gives their investigators. They stressed this is not tax legislation – it’s to deal with conduct that facilitates deliberate, dishonest behaviour.

Mr. York, HMRC’s Chief Investigator has years of experience, receiving a CBE from Queen Elizabeth for his outstanding service. A skilled investigator, he balances this with humanity and understanding of the big picture, pointing out “The vast majority of professionals are a force for good”. Appalling then to hear that a small minority of people who hold positions of trust such as lawyers, accountants, bankers and company directors would ever dream of turning a blind eye to what might be fraud, tax evasion or money laundering. Worse still, deliberately instigating fraud against the public purse or their own company.

Shockingly, that is precisely what some professionals have done during the pandemic, at a time when the UK was in danger and taxpayers’ money was quickly given out to help save jobs. It was refreshing to hear that HMRC treats these ‘professional enablers’ of fraud as a priority for their investigations. Mr. York spoke of the groundbreaking work HMRC undertakes to share data and collaborate with international partners across jurisdictions. When asked by the audience whether data disclosure by the ICIJ such as the Pandora Papers was a help or hindrance, he said some information was already known to them but HMRC always welcomes intelligence that can be used to help protect the public purse.

Speaking about the Corporate Criminal Offence (CCO) of failing to prevent tax evasion, Mr. Dean alerted the audience to how an organisation can be found guilty regardless of whether it had knowledge of the associated person’s criminal conduct. A defence is available if the company had Reasonable Prevention Procedures (RPPs) in place to prevent its associated persons from facilitating tax evasion.

He explained that this is why dynamic risk assessments, training and monitoring procedures are so important and why tick-box staff training is not enough. There is also a risk to M&A deals as buyers are extra cautious to make sure nothing has happened in the past that could result in the buyer being prosecuted later. HMRC themselves see corporations without procedures in place as being high risk.

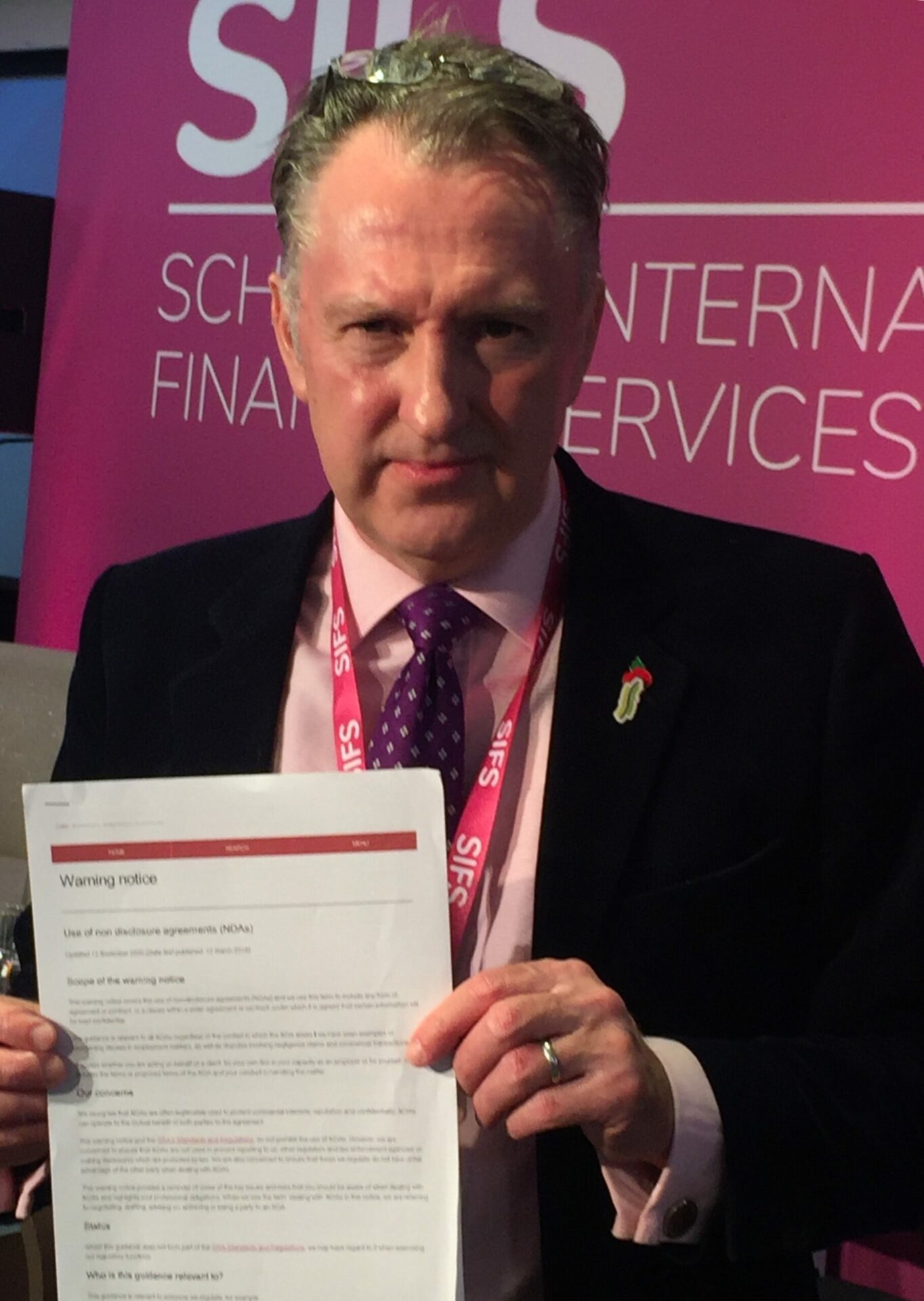

Speaking after HMRC, I told how having an effective procedure to encourage people to report suspected fraud or wrongdoing is crucial and in my talk, I told of how many people reporting fraud felt vulnerable and didn’t report things that could help prevent the company from being prosecuted later. Showing a copy of the Warning Notice issued by the Solicitors Regulation Authority, I highlighted this was a stark reminder that confidentiality agreements cannot be used to prevent someone reporting the SRA.

Speaking after HMRC, I told how having an effective procedure to encourage people to report suspected fraud or wrongdoing is crucial and in my talk, I told of how many people reporting fraud felt vulnerable and didn’t report things that could help prevent the company from being prosecuted later. Showing a copy of the Warning Notice issued by the Solicitors Regulation Authority, I highlighted this was a stark reminder that confidentiality agreements cannot be used to prevent someone reporting the SRA.

Not publishing data about Government aid given to companies to enable data matching to stop fraud and weaknesses in technology that should have been fixed after the 2008 crisis were my other core themes. The counter-fraud community provided the government with solutions to fix these, including the creation by banks of a central data repository to share and check data to identify fraud. Sadly, these are yet to be introduced. The FAP charity and partners with telecoms and technology expertise are also calling on government to make Big Tech companies accountable for things like fake adverts that are used to con millions of people by including fraud in the new online harms bill.

We are entering the 4th Industrial Revolution, a new era of what our tech entrepreneur CEO and UK Productivity ambassador, Jurga Zilinskiene MBE calls the Age of Wild Experimentation. This is where AI and ambitious new inventions will finally transform business and make people safer, happier and more productive. She’s compared it to the spirit of the Warner Brothers in 1929 who saw the benefits of talking movies and changed the industry when others businesses were stuck in the silent era where a pianist in a cinema played piano to accompany the film.

A century later, established Big Tech firms are facing their talking movie moment with DX for online safety. They have an important decision to make – they either roll-out existing tech tools now to protect their online customers from fake ads and websites (which fraudsters pay them to post) or they keep blaming their customers who fall victim. Whether legislation is introduced that forces Big Tech firms to change or not, the companies that don’t transform will be disrupted by new, visionary tech companies that do use powerful AI that makes people safer in the online and physical metaverse.

Like honest professionals, honest AI is a force for good that can to keep people safe, happier and better informed in every language. Talking movies didn’t kill movies, it created wonderful new opportunities. Making the online world a safer place after COVID-19 will be a lovely thing to emerge after the horrible darkness of the Pandemic.

My thanks to the Jersey School of International Financial Services for hosting the event and inviting me to give the Fraud Advisory Panel perspective on fraud in the Pandemic and I hope my talk was at least as helpful as my avatar’s.

Responses