The Cost-of-Living and the Energy Crisis for Households

Households across the UK are facing huge cost-of-living pressures, with inflation close to a 40-year high and real wages falling fast. While significant support from the Government will help reduce the scale of the living standards catastrophe this winter, the outlook is not bright, with incomes for non-pensioner households set to fall by 8 per cent over the course of this year and next.

Inflation Reached a 40-year High in July 2022

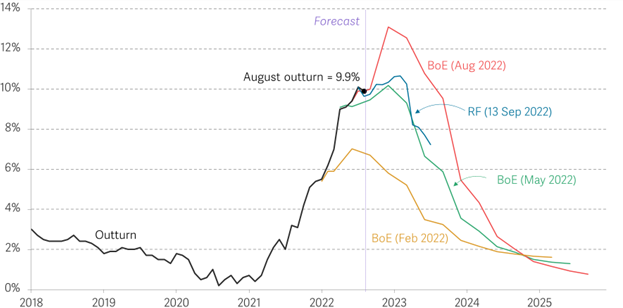

Inflation has risen from close to zero at the start of 2021 to reach a 40-year high of 10.1 per cent in July 2022. Since the start of the year, inflation has consistently surpassed official forecasts, and is now set to remain high, at around 10 per cent, until spring 2023 (see Figure 1).

Outturn and select projections for CPI inflation: UK

Source: RF analysis of Bank of England, Monetary Policy Report, various; ONS, Consumer price inflation.

The good news is that recent government support will both help to support households through the winter and reduce inflation in the near term. The Energy Price Guarantee, announced last month, will mean that annual energy prices for a typical household are capped at £2,500 for six months until March 2023. As a result, the expected peak in inflation has fallen from around 13 per cent (the Bank of England’s forecast in August) to slightly above the July peak of 10.1 per cent – a significant reduction.

Inflation is Higher Still for Low-Income Households

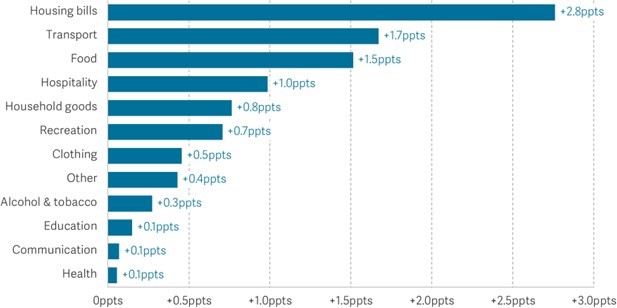

Current inflation is, unsurprisingly, driven by skyrocketing energy prices following the invasion of Ukraine; Figure 2 shows that housing bills (which include gas and electricity) contribute

2.8 percentage points to the annual inflation rate. However, other costs are rising fast too, with transport and food costs contributing 1.7 and 1.5 percentage points to annual inflation respectively. Indeed, while CPI rose by 9.9 per cent in the year to August 2022, food costs rose by 13.1 per cent over the same time period.

Contribution to annual CPI inflation: UK, August 2022 Source: RF analysis of ONS, Consumer Prices.

This type of inflation – driven by increasing costs of essential items like energy and food – hits low-income households the hardest. Not only are low-income families more exposed to the rising cost of living, since they are less able to cut back on spending – they also spend a greater share of their income on these essential items. Indeed, the poorest ten per cent of households spend three times as much as a share of expenditure on gas and electricity bills than the richest ten per cent.

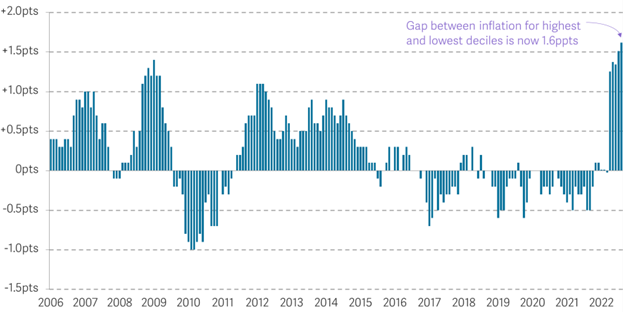

This means that low-income households face an even higher inflation rate than the headline figure. As Figure 3 shows, in August 2022, the poorest ten per cent of households faced an inflation rate that was 1.6 percentage points higher than the richest ten per cent. So, while inflation reached double digits in July this year, the reality is that low-income households have been facing inflation of over 10 per cent since the spring.

Gap between estimated CPI-consistent inflation rate for lowest equivalised disposable income decile and highest decile

UK Source: RF analysis of ONS, Consumer Prices & Living Costs and Food Survey.

When thinking about the impact of the cost-of-living crisis on young people, it is important to acknowledge that young people’s circumstances vary considerably, meaning that young people have a wide range of personal inflation rates. For example, young people who live with family and are not responsible for household bills will be facing a lower-than-average inflation rate, since they aren’t affected by skyrocketing energy bills. On the other hand, many young people who are working and living on their own will be at the sharp end of this cost-of

-living crisis, since young people are more likely to be in low-paying jobs, receive lower levels of social security benefits and have low levels of savings, so on average will have fewer ways to cope with rising inflation.

Government Support will Reduce the Scale of the Cost-of-Living Crisis this Winter

Finally, it is worth remembering that government intervention can make a big difference. For example, the Energy Price Guarantee introduced last month means that typical energy bills will likely be £1,074 lower over the next six months than otherwise. Indeed, when all government support introduced in 2022-23 is taken into consideration, policy intervention will offset the vast majority of recent energy price rises for most households.

However, this winter will still be tough for many. An average household on a pre-payment meter will have to find £264 in cash to pay for energy in January alone, since they cannot smooth the cost of energy bills over the year. Furthermore, households in poorly-insulated homes will struggle to keep their homes warm this winter and will face high energy bills as a result, yet there is little government support to help households insulate their homes. And while recent support for energy bills will boost household incomes and prevent catastrophic bills this winter, household incomes are still on course for a dreadful few years. Among non- pensioners, incomes are projected to fall by 8 per cent over the course of 2021-22 and 2023- 24 – this is significantly more than during the financial crisis, when incomes fell by 5 per cent between 2009-10 and 2011-12.

Recommendation 1

The Government should protect household incomes next year by increasing benefits in line with inflation, rather than earnings.

Recommendation 2

The Government should increase support to allow households to better insulate their homes, since the issue of high energy bills is particularly acute for those in poorly insulated homes.

Recommendation 3

The Government should include skills within any growth plan to deliver higher productivity, higher wages and higher incomes for households across the UK.

By Louise Murphy, Economist, Resolution Foundation

This article is part of Campaign for Learning’s series: Learning in the cold: The Cost-of-Living Crisis and Post-16 Education and Skills

Order of series

Day 1

Friday 21st October

- Louise Murphy, Economist, Resolution Foundation: The Cost-of-Living and the Energy Crisis for Households

- James Kewin, Deputy Chief Executive, Sixth Form Colleges Association: The Cost-of-Living Crisis and 16-19 Year-Olds in Full-Time Further Education

Day 2

Saturday 22nd October

- Becci Newton, Public Policy Research Director, Institute for Employment Studies: The Cost-of-Living Crisis and 16-18 Year-Olds in Jobs with Apprenticeships

- Zach Wilson, Senior Analysis Officer and Andrea Barry, Analysis Manager, Youth Futures Foundation: The Cost-of-Living Crisis and 16-24 Year-Olds ‘Not in Full-Time Education’

Day 3

Monday 24th October

- Nick Hillman, Director, Higher Education Policy Institute: The Cost-of-Living Crisis and Full-Time and Postgraduate Higher Education

- Liz Marr, Pro-Vice Chancellor – Students, The Open University: The Cost-of-Living Crisis and Part-Time Higher Education in England

Day 4

Tuesday 25th October

- Steve Hewitt, Further Education Consultant: The Cost-of-Living Crisis: Access to HE and Foundation Year Programmes

- Sophia Warren, Senior Policy Analyst, Policy in Practice: The Cost-of-Living Crisis, Universal Credit, Jobs and Skills Training

Day 5

Wednesday 26th October

- Paul Bivand, Independent Labour Market Analyst: Economic Inactivity by the Over 50s, the Cost-of-Living Crisis and Adult Training

- Aidan Relf, Skills Consultant: The Cost-of-Living Crisis and Employer Demand for Level 2-7 Apprenticeships

Day 6

Thursday 27th October

- Mandy Crawford-Lee, Chief Executive, UVAC: The Cost-of-Living Crisis and Employer Demand for Level 4+ Apprenticeships and Part-Time Technical Education

- Simon Parkinson, Chief Executive, WEA: The Cost-of-Living Crisis and Adult Community Learning

Day 7

Friday 28th October

- David Hughes, Chief Executive, AoC: The Cost-of-Living Crisis and FE Colleges

- Jane Hickie, Chief Executive, AELP: The Cost-of-Living Crisis and Independent Training Providers

Day 8

Saturday 29th October

- Susan Pember, Policy Director, HOLEX: The Cost-of-Living Crisis and Adult Education Providers

- Martin Jones, Vice-Chancellor and David Etherington, Professor of Local and Regional Economic Development, Staffordshire University: The Cost-of-Living Crisis – The Response of Staffordshire University

- Chris Hale, Policy Director, Universities UK: The Cost-of-Living Crisis and Universities

Responses