£2bn Levy Underspend: Has the demise of the levy been much exaggerated?

#Apprenticeships 2020: Expiring #Levy Funding and Premature Success Rates – Don’t Panic Yet!

There has been a lot of speculation about whether Levy Overspend could be causing Apprenticeship funding to run out.

(NB a monthly levy contribution that remains unspent for 2 years ‘expires’ and is no longer available for that employer to use).

However a recent Freedom of Information request response (16 Jan 2020) from the Dept. for Education* paints a more nuanced picture.

In 2019 Employers paid:

a combined total of £2,8bn into the levy pot (pg 179 HMRC)

In 2019 Employers Spent:

Just £864m of their combined levy pot (see tables below)

Levy Underspend in 2019:

An almost £2bn differential between input and output in one year alone!

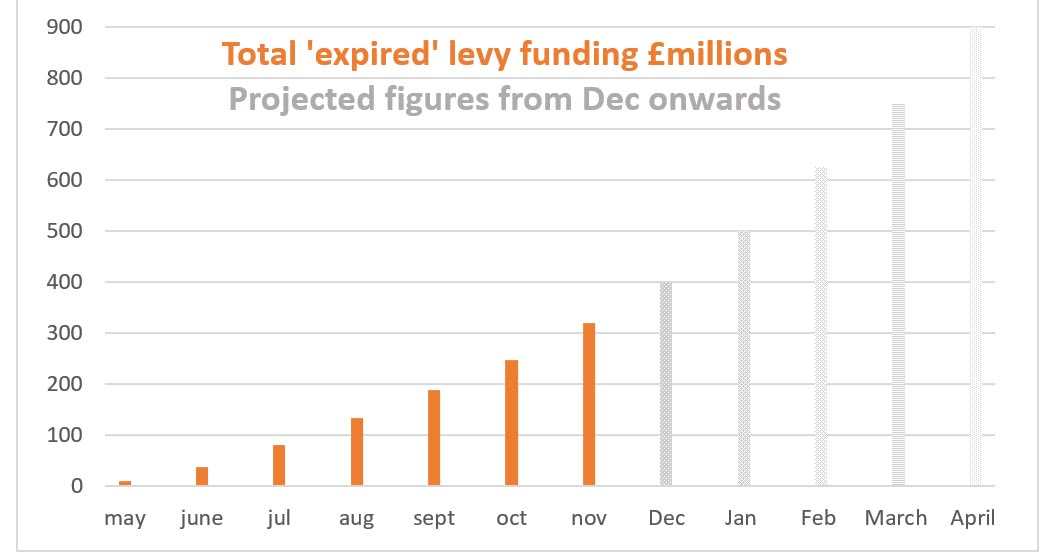

This mismatch has in turn led to a rapid increase in the value of unused or ‘expiring’ levy funds.

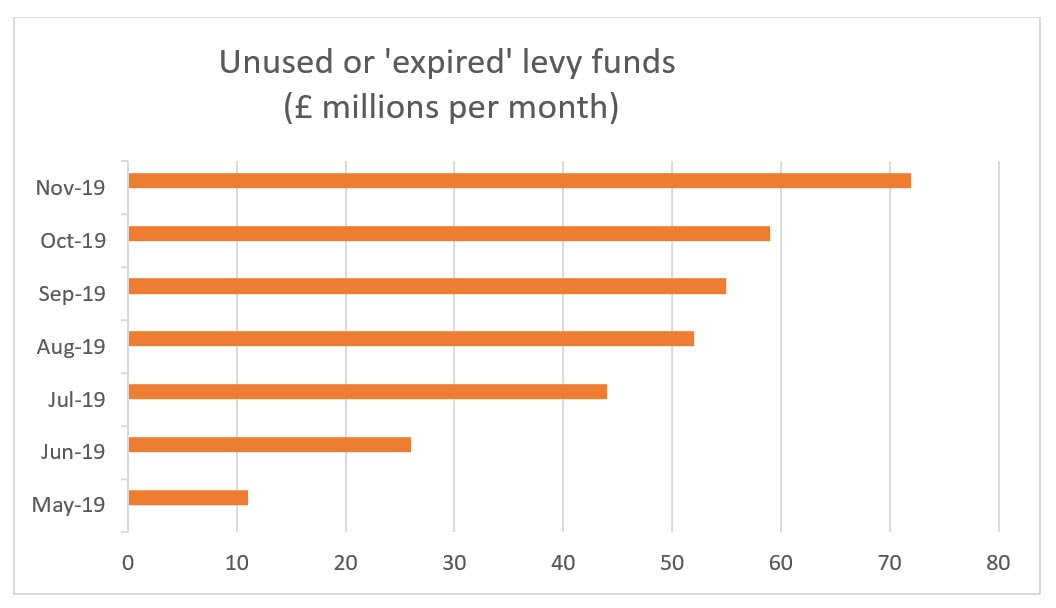

From an initial £11m in May ’19 to £72m in Nov ’19 and rising…

Table 1 – Expired levy funds per month £m May-Nov 2019

#See below for an explanation of Sept/Oct figures

Table 2 – Actual and projected expired Levy funds

And it is worth noting that the figures shown above refer only to the total value of expired levy funds in accounts registered with the Apprenticeship Service.

Levy-paying employers are not obliged to open accounts and not all have. So you can add up to c10% to the above figures to account for the money wasting away in non-opened Levy accounts, where it cannot be spent.

Why is the amount of ‘expiring’ funding increasing?

Each monthly payment has a 24 month life span and is subject to a ‘first in first out’ utilisation system which means that month 1 payments must be used before you access month 2 etc.

Thus unless an employer had an apprenticeship programme running on day 1 of the levy they will have built up a surplus by the time they make a withdrawal and had more time to spend their month 1 payment than to spend subsequent month’s.

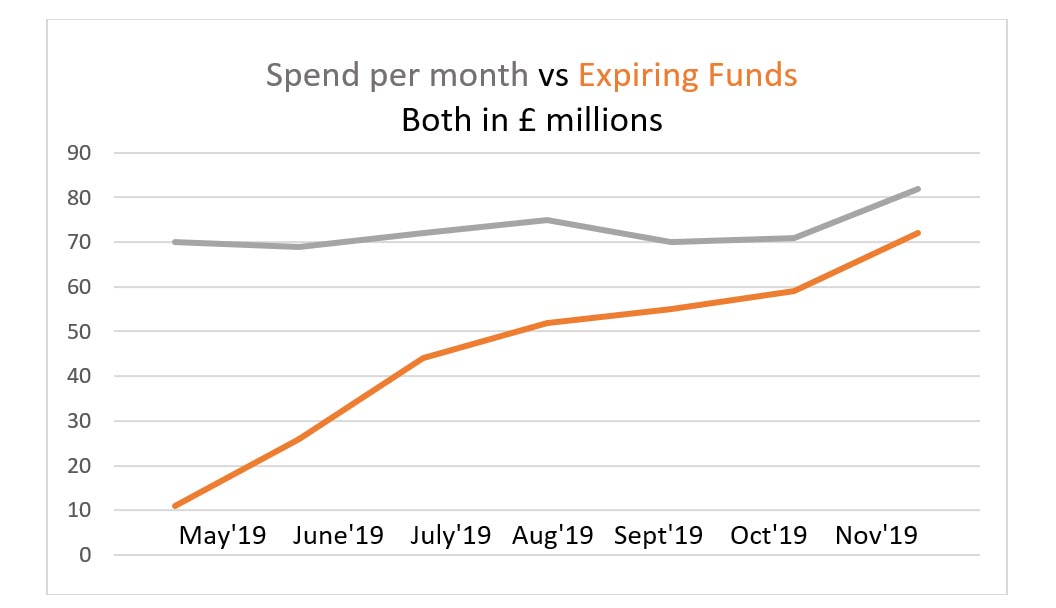

Money in and money out

So, how much of their levy are employers actually spending?

At the moment the amount being paid out by employers (by purchasing training) is clearly not rising as quickly as the amount being lost through levy ‘expiration’ and is only about 35% of the amount being paid in each month.

And of course at the end of July 2020 the amount of Apprenticeships available to spend money on will reduce as the old NVQ style ‘Frameworks’ are removed. Currently more than 30% of all Apprentices are on these doomed Frameworks.

Over the next few years as more employer’s programmes reach maturity there will be more completion payments (20% of the total) made, making it more likely that employers will start to use up their funds.

However on current trends parity between levy income and outcome is several years away and there should still be a surplus.

Table 3. The amounts that employers are ‘spending and losing’ in each month

Why does this all matter?

Firstly it is vital to see the impact of the levy on those who have been required to pay it: How is it increasing their engagement in training through apprenticeships?

But even more important, is the impact of the Levy on the wider Apprenticeship budget.

It is assumed that the levy will generate sufficient surplus to pay for all other Apprenticeships too (minus a 5% non-levy employer contribution).

DFE says that: Where employers do not spend funds available to them and they expire, the department uses the available budget to fund training for existing apprenticeship learners and new apprenticeships in employers that do not pay the levy.

Thus far this doesn’t seem to have been working effectively though as many providers have run out of apprenticeship funding for their non-levy paying clients.

It is unclear if this shortage is a short-term issue caused by the lag between levy input and outputs, ongoing ESFA contracting issues or if it is a long term imbalance between budgets and a forecasting failure.

Either way, now that non levy payers are using the levy system and their intentions are more transparent, it would be helpful to have an Apprenticeship funding guarantee for employers.

Mr Chancellor please note – what else would give British employers and workers more confidence than the guarantee of your support for high quality Apprenticeship training?

Premature success rates?

Further Education is judged by some harsh metrics when it comes to success rates.

Unlike Schools and Universities which are judged by the performance of those that make it to their final exams. Apprenticeship success rates count all those course-changers, course-leavers, and non-completers as ‘failures’. Even if the reason for non-completing was a good one – such as getting a promotion or going to University…

We have lived with this system for years and worked incredibly hard to improve results as a sector. However major changes such as the simultaneous introduction(s) of the Levy, the new standards and End Point Assessments has meant that success rates will take a few years to recover their equilibrium.

Just as with funding it will be years before inputs (starts) and outputs (passes) will be in harmony again.

High-quality training courses need at least 2 full cycles before their results can be seen as an average. Thus the achievement of excellence in standards delivery may take up to 8 years; beyond the patience of most policy makers and politicians.

In the meantime why not judge us using the same criteria as is used elsewhere in education? Namely our End-point Assessment (EPA) results.

Like a good beer, the new English Apprenticeship system will need to be left to settle before all becomes clear.

Richard Marsh, writing in a personal capacity, has over 20 years experience in delivering excellence in apprenticeships and training

#Note re September and October figures in all tables: To ensure employers and providers were not unfairly impacted as a result of an ESFA issue affecting apprenticeship payments, funding expiry was cancelled for September. All expiry due in September was rolled forward into October. In the above tables amounts labelled as October have been split between September and October (40-60) in each case. Totals remain the same and accurate.

*Freedom of Information request made on 16th Jan 2020 under the Freedom of Information Act 2000 (“the Act”):

i) How much Apprenticeship Levy funding has been collected from employers each month in 2019?

The apprenticeship levy is payable by all UK employers with an annual pay bill of over £3 million, charged at 0.5 per cent of an employer’s annual pay bill.

The Department for Education does not hold information on total Levy collected. HM Revenue and Customs (HMRC) is responsible for collecting the levy on behalf of government. This information is held by HMRC and is published in their annual report and accounts, which can be found here.

ii) How much levy funding has been utilised by employers in each month of 2019?

Levy-paying employers who choose to employ apprentices create accounts with the digital Apprenticeship Service in order to receive and manage levy funds spent on apprenticeships.

The value of the funds in each employer’s account will depend on how many of their employees live in England and the proportion of their PAYE bill paid to these employees. The funds made available to levy-paying employers also include a top-up of 10% after their English portion has been calculated. The table below shows monthly totals for January to November 2019 (figures for December 2019 have not yet been calculated):

|

Month and Year |

Payments Made Out of Apprenticeship Service Accounts |

|

Jan 19 |

£60,000,000 |

|

Feb 19 |

£67,000,000 |

|

Mar 19 |

£69,000,000 |

|

Apr 19 |

£70,000,000 |

|

May 19 |

£70,000,000 |

|

Jun 19 |

£69,000,000 |

|

Jul 19 |

£72,000,000 |

|

Aug 19 |

£75,000,000 |

|

Sep 19 |

£6,000,000 |

|

Oct 19 |

£135,000,000 |

|

Nov 19 |

£82,000,000 |

|

Dec 19 |

£89,000,000 |

- Figures have been rounded to the nearest million. Figures under 1m have been suppressed. Payments from levy accounts are a made monthly in arrears. Information is available at the end of each calendar month.

- The apprenticeships annual budget covers spend from accounts, spend on small employers, additional payments and the costs of apprenticeships from previous years.

- Levy Paid into accounts includes 10% Government top-up.

- Payments made out of apprenticeship service accounts relate to the apprenticeships learning element only and exclude any other items that are not funded from employers’ funds in their apprenticeship service accounts, such as English and Maths training.

- In September the ESFA did not make most payments through the apprenticeship service due to an issue with the data match process. This issue did not affect payments relating to the 2018/2019 funding year and these were made as normal in September. The issue was resolved for October payments so there are a higher number of transactions to reflect the value earned for both months.

iii) How much unspent Levy funding has been ‘retired’ each month?

| Month | Expired Funds |

|

May-19 |

£11m |

|

Jun-19 |

£26m |

|

Jul-19 |

£44m |

|

Aug-19 |

£52m |

|

Sep-19 |

– |

|

Oct-19 |

£114m |

|

Nov-19 |

£72m |

- Figures shown above refer only to the total value of expired levy funds in accounts registered with the Apprenticeship Service. Levy-paying employers are not obliged to open accounts with the Service.

- The Apprenticeships Levy was introduced in 2017. Each levy payment expires 24 months after paying-in, unless it is spent. Therefore, May 2019 was the first month in which expiry occurred. To clarify, expired levy funds are not reclaimed by HMRC or Her Majesty’s Treasury (HMT). Employers’ levy funds are distinct from the Department for Education’s ring-fenced apprenticeship budget, which is set to fund apprenticeships in England. The budget has been set in advance by HMT for the current Spending Review period. Where employers do not spend funds available to them and they expire, the department uses the available budget to fund training for existing apprenticeship learners and new apprenticeships in employers that do not pay the levy.

- To ensure employers and providers were not unfairly impacted as a result of an issue affecting apprenticeship payments, funding expiry was cancelled for September. All expiry due in September was rolled forward into October.

Responses