Apprenticeship Service developments: Refining and expanding the Levy funding system

The latest DfE data shows that there are now over 11,000 employers who have opened their Apprenticeship Service (AS) levy account (end of September ‘17). Steady if not spectacular progress.

Those employers that taken the plunge and opened accounts have found that it works! – but that some of the functionality is very limited and they are not to be able to do all that they might expect or want to do.

If we are to get all 20,000 levy payers (and potentially all employers) using the system, then it will have to become a lot more user friendly. The current system has given employers purchasing power but also created a lot of extra administration for them – and for their providers.

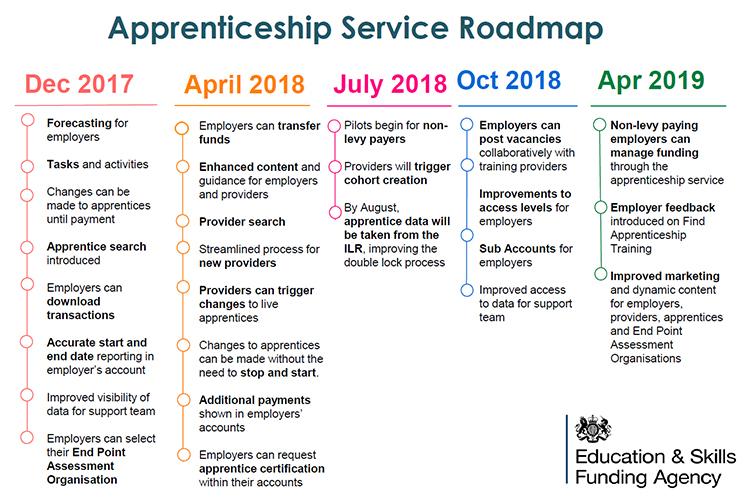

At the AELP autumn conference Keith Smith (Director, Funding and Programmes, ESFA) gave us an insight into the developments that have been planned to improve and expand the functionality of the service (see roadmap below).

Initial enhancements

The enhancements planned for the end of this year should give employers greater visibility and control over their accounts. With new functions such as forecasting and a window for editing an apprentice’s details particularly helpful at the early stages of set-up.

Employers will also be able to select their preferred End Point Assessment Organisation and eventually pay them directly (rather than via their provider). This is something that will help employers to clearly distinguish between training provider and EPA roles (and costs) and again gives them more control, which we should all welcome. However the employer and provider will need to work closely to avoid any confusion and to allow the provider sufficient time to agree a way of working with the chosen EPA.

Spring 2018 changes

Most significant of the planned April 2018 changes is for employers to be able to transfer some of their unspent levy funds to other employers (possibly up to 10%). This much heralded function could lead to some interesting employer – employer relationships, for example allowing larger employers to help upskill their smaller suppliers.

However the attitude of many employers is that they wish to do less apprenticeship admin – not more. And so the ability for them transfer funding and even order their own Certificates for example, might not be necessarily seen as a bonus (anyone who has ever had to order Apprenticeships certificates at volume will wince at this point).

Next academic year we could see the integration of the AS and the ILR (surely a marriage made in heaven). An intelligent union will reduce the number of times that data has to be entered for example and would allow providers to fully control the data (with employer agreement) meaning that employers will be able to delegate much of the admin back to trusted providers.

All aboard

This will be important as the next big step planned for 2019 is for all employers (levy paying or not) to start using the system. Such a wholesale change will only be possible if the system is working smoothly and is intuitive enough for most to use it without help or instruction.

Of course the other big impact of all employers using the system is that it would end the system of funding allocations and contract management (for apprenticeships at least) as each employer would be in effect commissioning their own 90% subsidies.

This would be a huge change and signify a complete break with the FE provider funding system that, love it or loathe it, has been around for the past 20 years.

Evidence of this change is starting to appear though, with 11,000 pioneer employers now spending their own apprenticeship budgets and the ESFA starting to talk a lot more about services and systems and a lot less about contracts and performance.

There is a long way to go before all of this is reality of course and no one will be surprised if there were one or more unforeseen technological, policy or practise ‘issues’ that mean the system doesn’t materialise exactly as planned.

Richard Marsh, Apprenticeship Partnership Director, Kaplan Financial

Responses