Apprenticeship levy funding transfer

Making the most of the evolving DAS system in England.

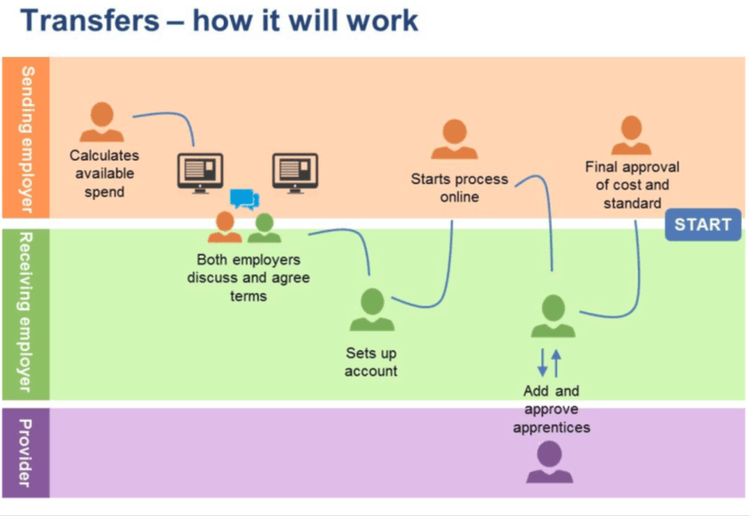

The ESFA have recently confirmed plans to introduce enhancements to the Digital Account System from ‘April’ 2018.

Most significant of which is the ability for levy paying employers to transfer up to 10% of their levy pot to other employers (….to be spent on Apprenticeship standard training in England….).

This is quite timely as I suspect sooner or later the fact that there is £1bn+ sat unspent in levy accounts might become a headline… anything that helps move money from the under spent Levy world to the under resourced non levy world should be welcomed by us all.

What is this about and what is it designed to achieve?

There are already several ‘10 percents’ in Apprenticeship funding – the 10% extra funding added to English levy payments to ensure that “employers can get out more than they put in”.. the 10% contribution for non-levy funding (90-10) and the 10% of deprived areas attracting extra funding ..[i]

However the ‘10% transfer’ was first mooted in 2016 and was designed to allow larger employers to ‘support their supply chains’ but from what we have seen so far there doesn’t seem to be any restriction as to whom employers can donate funding to. I.E. it doesn’t look as if this is being restricted to agreements between large companies and just their suppliers.

This is good news as no one needs more complexity when it comes to funding.

So in terms of what this is designed to achieve; I don’t think that there is any longer a clear policy objective.

Like so much that happens in our world, its origins have been lost in time and it is now being done because it seems helpful and progressive and because ‘we said we will do it’, so we will.

The basics rules of the 10% transfer are that :

- It can only be spent on ‘standards’ not Frameworks and is restricted those working in England

- The specific standards have to be agreed as well as the rates

- The receiving employer has to open a Levy account

- All normal funding rules apply (ie Cap, Payment profile, Register etc )

Who will want to do this and why?

So who would want to donate their funding, and who would want to receive funding?

Donor motivation:

I think there a few reasons levy paying employers would donate levy funding :

- Levy utilisation – many employers will find they don’t need all of their levy funding – especially if they aren’t growing as a business and headcount is frozen. So in a sense it won’t cost them anything to give away ‘excess’ funding that they have already paid. HMRC are going to pocket it after 24 months if no one uses it anyway….

- Corporate Social Responsibility – this is a great chance to help communities locally or specifically. For example a donor employer might make this funding available to those who hire local unemployed people and underrepresented communities or to help smaller businesses that want to expand.

- Supply chain upskilling – it could be used by employers to encourage businesses that supply them to ‘do more’ training – for example to better match technological advances or standards. Or to magnify the impact of the donor’s apprenticeship vision (we take on apprentices and so do our suppliers).

- Cohort aggregation – even large employers can struggle to create and fill a class and to make each standard viable for providers. This could be good way to find the ‘extra apprentices’ needed to enable a provider to create a course in a particular location.

- Shared expertise – an employer with expert training staff or facilities, might use this as a way of sharing that expertise. And an ‘Employer-provider’ might see it as a way to create an income stream by supplying the training. Although I think it would then make them a Provider (not and Employer-Provider) and I would always advise caution when it comes to paying yourself with public funds..

So plenty of reasons why an employer might ‘donate’ but why might one want to ‘receive’?

- Money – not least of all saving the 10% smaller-employer-cash-contribution. On the face of it there is potentially £20m PCM available for smaller employers

- Funding availability – non levy contracts values are very low and it is hard to find providers with funding – this is a potential solution – find an employer with cash instead! And it’s also a way for smaller employers to test the water with apprenticeships and the apprenticeship levy system

- Supply chain relationships – perhaps focused on quality, technology or a shared vision and values

- Cohort aggregation – a chance to aggregate demand and make learning more viable – I could really see an SME adding a learner or two to a large hosts cohorts

- Access to expert training / facilities – as above

Why wouldn’t you do this?

So on the face of it there seems to be a few reasons why this could be a good idea.

In terms of the potential negatives,

- Administration – this is the most likely road block I think. Which large levy paying employer is actually looking for additional Levy administration? With the possibility of employers one day also having to find and procure EPAs this could be a process too far. Of course this is then also an opportunity for providers to offer their support services…

- Change of relationships – once an employer becomes a donor, a new form of agreement will be required between them and the recipient. Risk and reputation are put on the line.

- State aid – again 10% (what else!) of this counts as State Aid – please take your own legal advice here….

So overall this is a very interesting and usual funding idea and I think the ESFA deserves credit for actually seeing it through.

I do not know if it will remain an unusual experiment or become a bridge into something bigger, I guess its popularity and reputation (scandals kill experiments) will dictate that.

Happy national apprenticeship week!

Richard Marsh, Apprenticeship Partnership Director, Kaplan Financial

[i] the £600 for training (on Frameworks) for those in the top 10% most deprived areas.

Responses