Earnings hit for lower earning student loan borrowers is set to be even higher than previously thought

This morning (2 Mar) we have updated analysis of the new student loans system presented last week by the Department for Education which finds the earnings hit for lower earning student loan borrowers is set to be even higher than we previously said.

This is because we have now found a crucial tweak in the supporting documents.

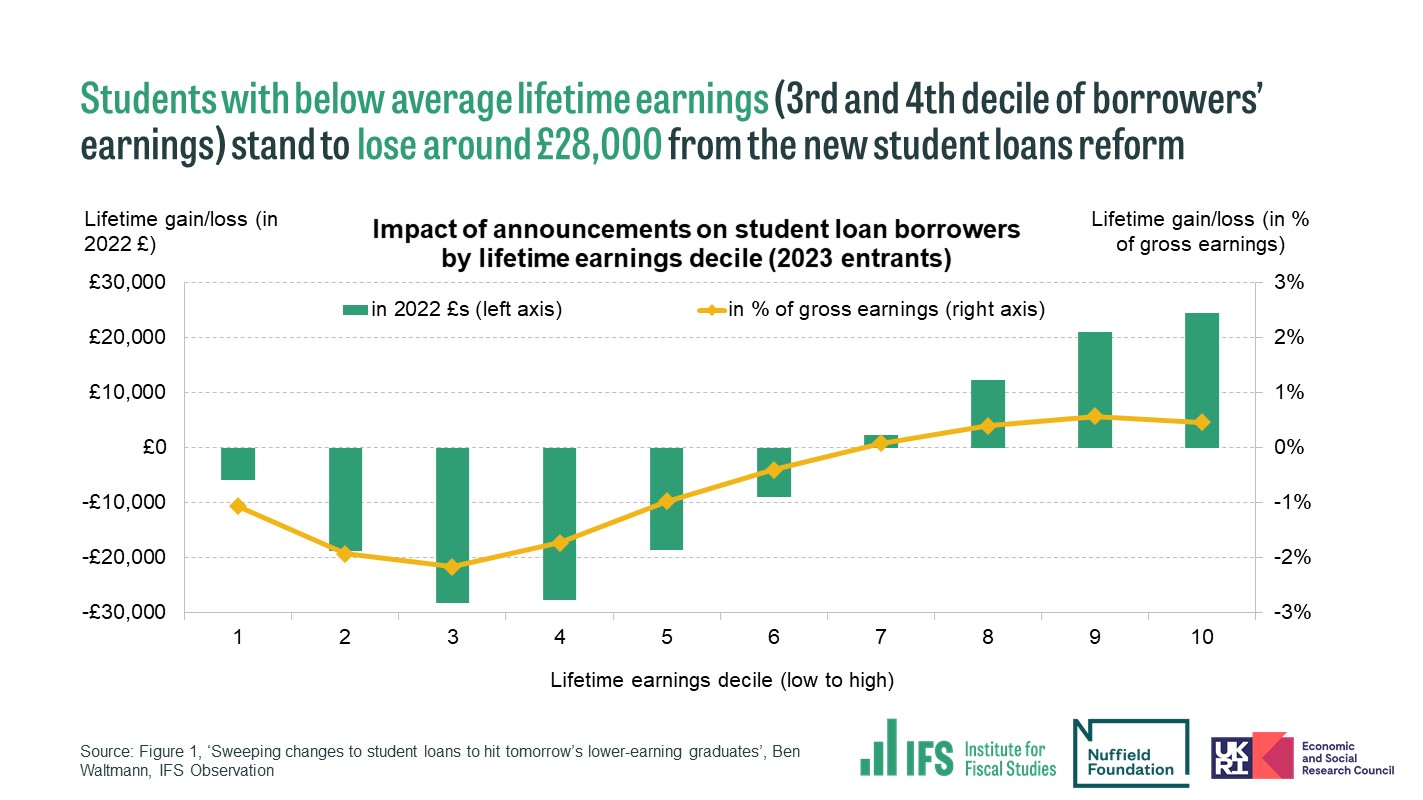

We estimate that those in the third and fourth earnings decile will be paying £28,000 more towards their student loan over their lifetime, rather than £15,000 and £19,000 as we originally said.

After being frozen until the 2026/27 fiscal year, the student loan repayment threshold will in the future be indexed to RPI inflation instead of average earnings. Because of RPI reform, RPI will be the same as CPIH from 2030. According to the latest OBR forecasts, this means that from 2030, the repayment threshold will rise by ~1.7 percentage points less every year than it otherwise would have done.

As a result, the reform will save substantially more for the taxpayer than we previously thought. We now think the net long-run saving on loans will be £2.3 billion per cohort rather than £1 billion (undiscounted RPI real terms).

This change also applies to borrowers under the current system (2012-2022 university starters). It is a massive retrospective change in repayment conditions that will hit lower middling earners the most.

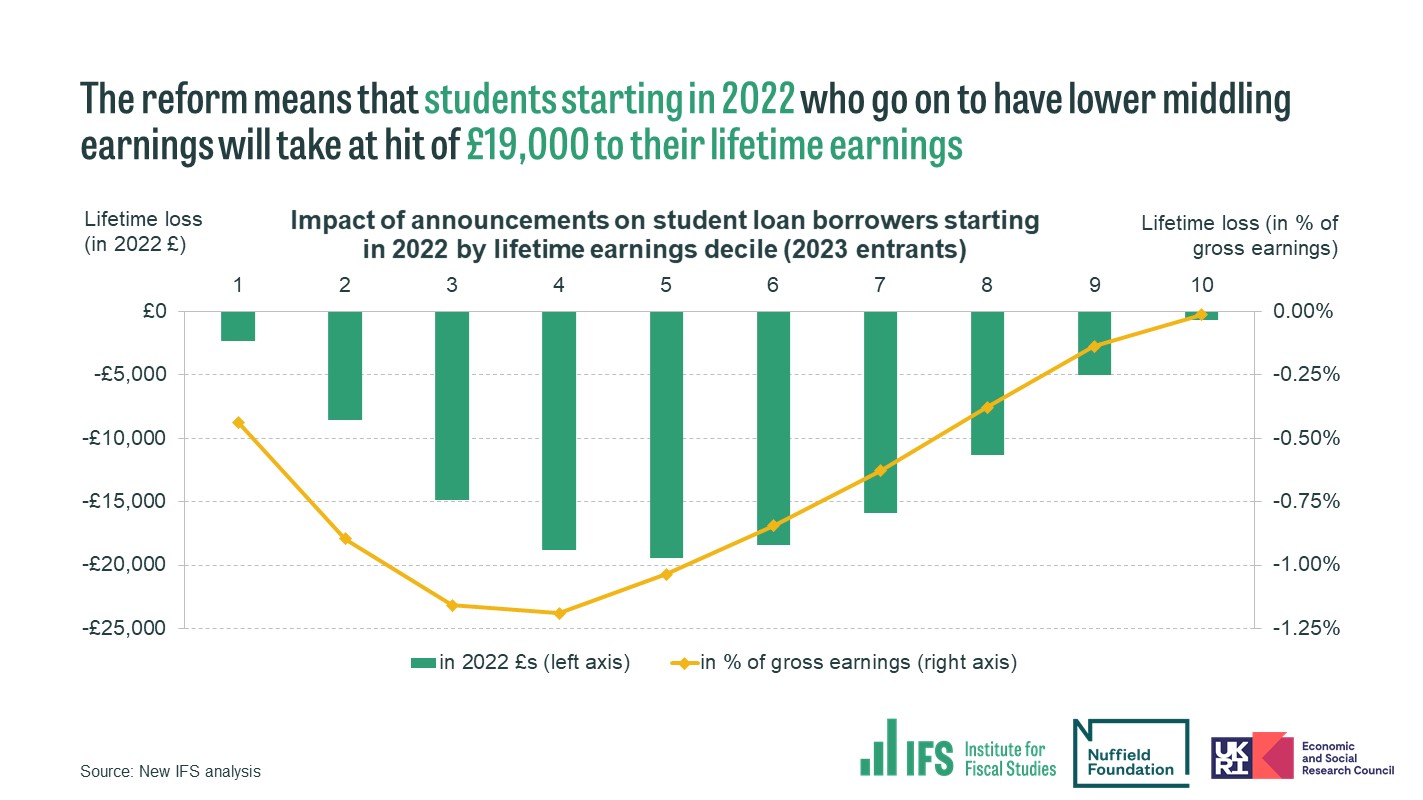

We estimate that the lifetime hit from changes announced this year for 2022 starters who go on to have lower middling earners will be £19,000 (undiscounted CPI real terms), and nearly as much for earlier cohorts.

Sweeping changes to student loans to hit tomorrow’s lower-earning graduates

24th Feb 2022: Today the government has announced the largest changes to the student loans system in England since fees were allowed to triple in 2012. Starting with the 2023 university entry cohort, graduates will pay more towards their student loans each year and their loan balances will only be written off 40 years after they start repayments. For the same cohorts, the interest rate on student loans will be reduced to the rate of increase in the Retail Prices Index (RPI), a large cut of up to 3 percentage points. Maximum tuition fees will be frozen in nominal terms until the 2024/25 academic year.

These changes will transform the student loans system. While under the current system, only around a quarter can expect to repay their loans in full, more than 60% can expect to repay under the new system. This is partly due to substantially higher lifetime repayments by students with low and middling earnings and partly due to less interest being accumulated on loans. The long-run benefit for the taxpayer will be modest at around £1 billion per cohort of university entrants, as higher repayments by borrowers with low or middling earnings will be mostly offset by lower repayments of high-earning borrowers.

Ben Waltmann, Senior Research Economist at the Institute for Fiscal Studies said:

‘The changes to student loans announced today are the biggest shake-up of the student loans system in a decade. High-earning borrowers stand to benefit substantially from lower interest rates, but those with lower and middling earnings will lose more than £15,000 in today’s money over their lifetimes as a result of a lower repayment threshold and a longer repayment period that means many borrowers will still be making student loan repayments as they enter their 60s. These losses come on top of the effect of real cuts in maintenance loans and the recently announced freeze in the repayment threshold, which also hit graduates with low and middling earnings.’

Responses