Fall in Permanent Placements and Further Slowdown of Salary Growth in October

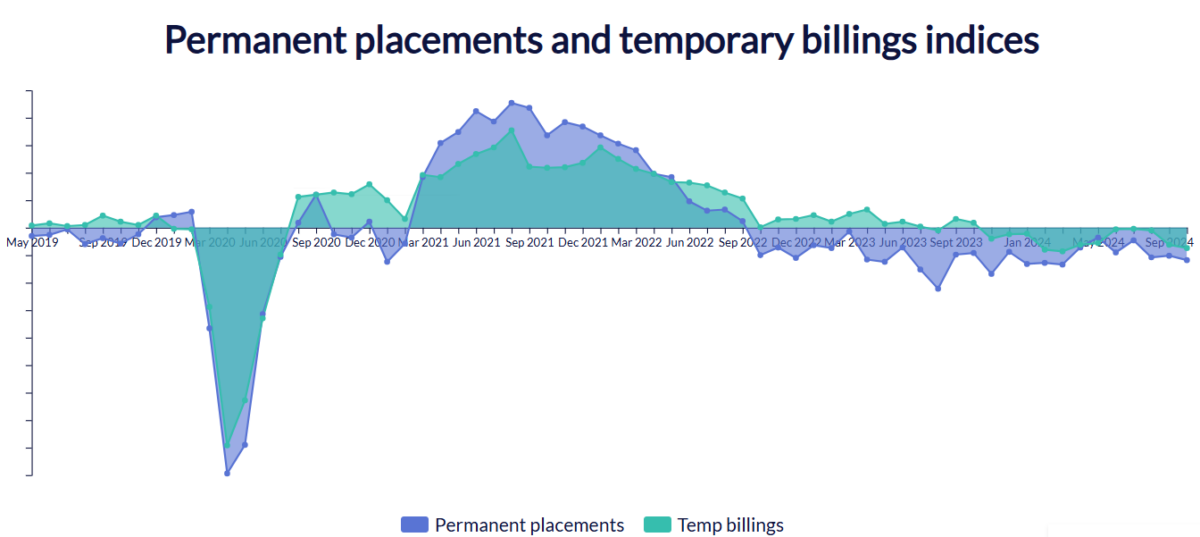

October’s KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, signalled further declines in both permanent and temporary placements during October. Rates of decline were the steepest since March, amid reports of reduced demand and hiring freezes at firms. Some recruitment consultants reported that the late October government Budget had led to uncertainty and reduced activity.

Whilst firms signalled willingness to pay higher salaries to suitable candidates, permanent salary growth softened in October to its lowest level since early 2021. Temp rates also rose only modestly, although growth was the best since June. Noticeably, higher staff availability amid a reduced number of vacancies was also seen during October.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

The KPMG/REC Report on Jobs survey signalled a further decline in permanent placements during October, extending the current period of contraction to over two years. The rate of contraction also accelerated, reaching its steepest since March.

There were reports of recruitment freezes at firms amid ongoing business uncertainty ahead of the late October government Budget. Similar factors led to the steepest reduction in temp billings for seven months.

Permanent pay growth sustained its recent downturn in October, falling to its lowest level since February 2021. Although some firms were willing to raise starting salaries for high quality candidates, increased staff availability and reduced demand for workers weighed on growth. Temp rates meanwhile increased following little change in September, but the rate of growth was modest and well below the survey’s historical trend level.

Demand for staff continued to decline during October, falling for a twelfth successive month. The rate of contraction also picked up, reaching its steepest since the start of 2021. Once again, declines in vacancies were common for both permanent and temporary staff workers.

The overall availability of staff continued to increase steeply during October. Lower demand for workers and reports of redundancies underpinned the twentieth successive monthly rise in availability. The increase in temps was notable in being the sharpest recorded by the survey since December 2020.

The decline in permanent placements was broad-based across England. The steepest fall was again seen in the South of England. London recorded the smallest contraction.

Temp billings declined steeply in London and the South of England. In contrast, solid growth was seen in the Midlands.

Except for marginal growth in Blue Collar and Engineering, all sectors recorded a fall in permanent vacancies during October. The steepest declines were seen in Retail and IT & Computing.

Only Blue Collar recorded growth in temp vacancies during October, and even here the net increase was only marginal. Executive & Professional and IT & Computing registered the steepest contractions in temp vacancies

Commenting on the latest survey results, Jon Holt, Group Chief Executive and UK Senior Partner KPMG, said:

“Uncertainty over the Autumn Budget saw businesses continue to put hiring plans on hold during October leading to the steepest contraction in permanent staff appointments since March. But employers didn’t turn to temporary staff to fill gaps, with these appointments also facing their biggest reduction in seven months.

“While businesses are still willing to pay more for top talent, the growing pool of available candidates means salary inflation was at its weakest since early 2021. The Bank’s Monetary Policy Committee will have considered this trend in their meeting on Thursday.

“With many of the tax rises announced in last week’s Budget impacting businesses, the expectation from some chief execs is that this could further dampen hiring as companies grapple with absorbing any extra costs. However, with the Office for Budget Responsibility forecasting a rise in productivity and a Budget that signalled more long-term policy making, businesses may feel that this all brings some degree of certainty.”

Commenting, Neil Carberry, REC Chief Executive, said:

“These figures are a timely reminder that demand from employers for new staff has weakened since the election – though the overall picture remains resilient by comparison to pre-pandemic. There are a few positive signs in this month’s data – like more robust performance in London, which is often a bellwether. But things now stand in the balance – firms need to be persuaded to invest, with recent changes to NI thresholds, the minimum wage and prospective changes to employment law all causing concern. Firms will be looking for the Government to deliver a clear, stable growth plan and detailed regulatory changes that enable firms rather than put them off over the next few months. Temporary work in particular is a fantastic way of helping people take steps out of inactivity, and the threat of new employment laws undermining opportunities for workers must be addressed.

“There is little in the pay data in today’s report that suggests the Bank of England should step away from further cuts to interest rates, which will also boost business confidence. And data on shortage sectors is a timely reminder that delivering on a skill strategy that is aligned to business needs is one of the biggest things Government and businesses could achieve working together.”

Responses