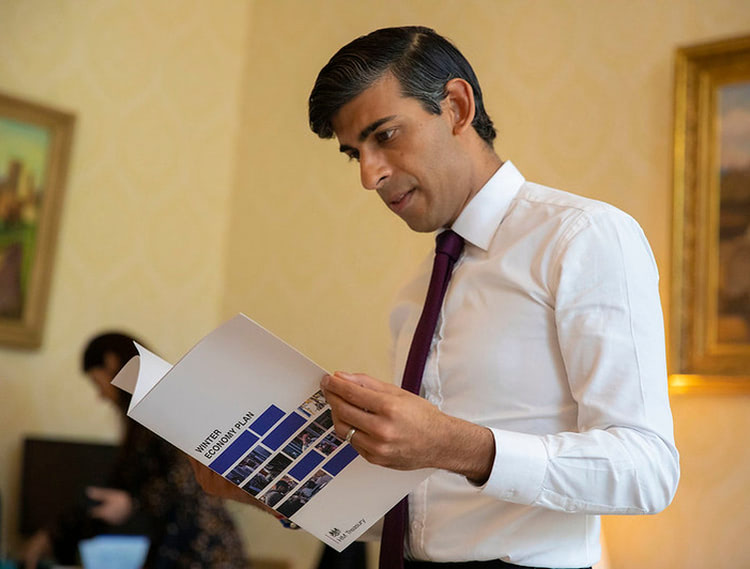

CHANCELLOR OUTLINES WINTER ECONOMY PLAN

@RISHISUNAK #PLANFORJOBS – Rishi Sunak unveils government’s plan to protect jobs and support businesses over the coming months

Central to plan is a new Job Support Scheme and extension of Self Employment Income Support Scheme

And over one million businesses will get flexibilities to help pay back loans

The Chancellor Rishi Sunak today outlined additional government support to provide certainty to businesses and workers impacted by coronavirus across the UK.

Delivering a speech in Parliament, the Chancellor announced a package of measures that will continue to protect jobs and help businesses through the uncertain months ahead as we continue to tackle the spread of the virus.

The package includes a new Jobs Support Scheme to protect millions of returning workers, extending the Self Employment Income Support Scheme and 15% VAT cut for the hospitality and tourism sectors, and help for businesses in repaying government-backed loans.

The announcement comes after the Prime Minster set out further measures to combat the spread of the virus over the winter, while preserving the ability to grow the economy.

The Chancellor of the Exchequer Rishi Sunak said:

The Chancellor of the Exchequer Rishi Sunak said:

“The resurgence of the virus, and the measures we need to take in response, pose a threat to our fragile economic recovery…

“Our approach to the next phase of support must be different to that which came before.

“The primary goal of our economic policy remains unchanged – to support people’s jobs – but the way we achieve that must evolve.”

Since the beginning of the pandemic, the government has taken swift action to save lives, limit the spread of the disease and minimise damage to the economy.

Ministers have introduced one of the most generous and comprehensive economic plans anywhere in the world with over £190 billion of support for people, businesses and public services – including paying the wages of nearly 12 million people, supporting over a million businesses through grants, loans and rates cuts and announcing the Plan for Jobs in July.

The government has been consistently clear that it would keep its support under review to protect jobs and the economy, with today’s action reflecting the evolving circumstances and uncertainty of the months ahead.

Sector Response to the Winter Economic Plan

Chief Executive of Association of Colleges, David Hughes said it must go hand in hand with a Jobs Training Scheme:

Chief Executive of Association of Colleges, David Hughes said it must go hand in hand with a Jobs Training Scheme:

“The government has made a sensible decision to protect jobs through its new support scheme. We look forward to seeing the details but hope this will reduce the number of apprenticeship redundancies. We remain concerned that the measures are still focused on jobs only. The retention scheme is now a support scheme. Perhaps the next step is a training scheme – a JTS. Now is the time to start planning for the vastly different labour market people will need new skills for, and unfortunately redundancies will still have to made, these people need the opportunity to retrain as quickly as possible to get back on their feet.

“The chancellor has not yet set a date for the autumn budget. Some funding paid to colleges runs out in March 2021. We hope that the Treasury confirms departmental budgets in November and acts on college funding in the forthcoming spending review.”

Association of Employment and Learning Providers managing director Jane Hickie said:

Association of Employment and Learning Providers managing director Jane Hickie said:

“The chancellor was well within his rights to say that the Plan for Jobs contained welcome measures to support skills training including the incentives for apprenticeships and traineeships.

“We were of course concerned that Kickstart might crowd out new apprenticeship opportunities and that there was more needed to protect the jobs of current apprentices but if the new Job Support Scheme keeps many of them in employment, this is another good step forward.”

Charlotte Alldritt, Director, Centre for Progressive Policy commented:

Charlotte Alldritt, Director, Centre for Progressive Policy commented:

“The Chancellor has missed another crucial opportunity to put training and skills at the forefront of efforts to prevent future mass unemployment. At the start of the Job Retention Scheme, the Centre for Progressive Policy (CPP) called for a turbocharged Right to Retrain, enabling workers on furlough to access training for new or higher level skills. As lockdown eased, there would have been another opportunity to fast track blended in-person and online learning.

“Now there is even greater urgency for skills training – particularly for people on currently furlough and facing redundancy. The Chancellor’s new wage subsidy scheme must be accompanied by a Learning Living Allowance for those made redundant. Whilst it is true the government cannot protect every business or every job, it is vital it gives financial support for people to access new opportunities.”

Helen Barnard, Director of the independent Joseph Rowntree Foundation, said:

Helen Barnard, Director of the independent Joseph Rowntree Foundation, said:

“The Chancellor’s initial policy response to the economic impact of Covid was bold and compassionate. We need the policy response to the next wave to be similarly bold, but the announcements today failed to meet that test.

“Jobs that have been viable in the past and will be again in the future need specific support to get through the current crisis. But the design of this scheme risks undermining its success and leading to more job losses by creating an unnecessary disincentive to employers to make use of it.

“Where jobs are truly not viable, the government must urgently make good on its manifesto promise to establish a Right to Retrain so that whole areas and industries are not cut adrift amid a gathering storm. Too many people now find themselves on the brink of being pulled further into poverty during the course of this year – people in the lowest paid roles, in areas where there are fewer new opportunities, and sectors where close contact is unavoidable.

“The mark of a compassionate society also has to be that we protect the worst off during hard times, and this makes retaining the lifeline of the £20 uplift in Universal Credit and extending it to legacy benefits even more crucial. Without a budget to address these wider issues, we need to hear from the Chancellor urgently about how he will help the worst off who look set to be the least well equipped to face the coming storm.”

Kirstie Donnelly MBE, CEO of City & Guilds Group said:

Kirstie Donnelly MBE, CEO of City & Guilds Group said:

“Today’s announcement by the Chancellor feels more like a sticking plaster than a long-term solution that will help to keep people in work. Whilst the new job support scheme goes some way to saving ‘viable’ jobs in the short term, it also raises the question of what will happen to all of those in ‘non-viable’ jobs in hard hit industries who are set to be displaced – and the resulting job losses that could significantly impact the UK economy.

“This is our act now moment and we are urging Government to develop a more permanent solution to provide meaningful, long-term support to stem unemployment. In our CSR submission we detail how skills funding could be better used to help people understand their transferable skills as well as the new skills needed to get back into work. Unless we think differently and help people to retrain and reskill throughout their careers we run the risk of a whole generation of people being permanently left behind.”

IES Director Tony Wilson said:

IES Director Tony Wilson said:

“While there were positives in today’s announcements, I am concerned that there just may not be enough either to protect viable jobs now or to support new jobs in future.

“On the plus side, the additional forbearance on VAT payments and loans will give struggling firms some much-needed breathing space, while the new Job Support Scheme will make it easier for companies trying to avoid cutting hours or making redundancies. Doing so can often be time consuming and costly for firms, and the vast majority want to do the right thing – so this scheme should help them to do that.

“However, we know that in many cases firms are reducing workers’ hours already and that they can make people redundant at very low cost. So there must be serious doubts as to why firms in those circumstances would sign up to a scheme that will actually cost them more money, by requiring them to top up salaries for hours that staff don’t work. The sad reality is that many firms will either choose not to sign up to the scheme or will feel that they cannot afford to, and it will be the lowest paid and least secure workers who will end up losing out. Our research has found that these issues existed on a small scale in the current Job Retention Scheme, but what were cracks in the JRS risk being gaping holes in its successor.

“A more conventional short-time working scheme where government tops up employee salaries, or a wage subsidy scheme where it tops up the employer, would have avoided these issues. It is hard to understand why something more conventional wasn’t announced today, given the diverse range of voices calling for either a short-time working scheme, wage subsidies or both.

“There were also some big omissions today, most notably in the continued absence of any significant measures to support new hiring or to invest in retraining for those out of work or at risk of redundancy. We have not shut down the whole economy this week, but we have added hugely to economic and employer uncertainty – which is further exacerbated by the prospect of an ever-harder Brexit in three months’ time. Ultimately, the way out of this crisis will be to both protect existing jobs and create new ones. And with vacancies flat and hiring weak, we need to make it easier and cheaper for employers to take people on. Today was a missed opportunity to do that.”

Kate Palmer, Associate Director of HR Advisory at Peninsula, said:

Kate Palmer, Associate Director of HR Advisory at Peninsula, said:

“In a week of significant announcements from the House of Commons, today’s statement from the Chancellor was hotly anticipated by businesses across the UK. As previously expected, it provided final confirmation that the furlough scheme is to end on 31 October, with the Chancellor resolute in his assertion that it will not be extended, in any capacity, despite calls for him to do so.

“Its replacement, the Job Support Scheme, would certainly appear to provide a lifeline for businesses who were concerned what the end of furlough would mean, however, this is a very different beast to the original Job Retention Scheme. The Chancellor was keen to note that the UK is not in the same position as it was in March, and economic aid from the government needed to reflect that.

“This new scheme now requires employees to work a minimum one-third of their normal hours, which is a vast difference from the previous requirements of the furlough scheme that provided financial assistance when businesses could offer staff no hours. This time, the government’s contribution will be less and, unlike the furlough scheme, employees on the Job Support Scheme will not be able to be made redundant.

“A key positive to take from this announcement is the eligibility for its use – it is open to all small and medium-sized businesses across the UK, regardless of whether they previously used the furlough scheme, although, further guidance on what an SME is for this scheme will presumably be provided later. While larger businesses are not automatically eligible, they will still be able to use it if they have suffered a drop in turnover. Businesses who use the scheme will also be able to claim for the Job Retention Bonus provided they are eligible for this bonus, meaning the use of the Job Support Scheme will not take away the promise of a company receiving £1,000 per previously furloughed employee that they keep on until 31 January 2021.

“The scheme, which starts on 1 November and is expected to run for six months, might be just enough to help businesses to retain more employees as we face the prospect of a challenging winter. As it’s impossible to predict what position we will be in by May 2021, it remains to be seen what will happen when this scheme comes to an end.”

Dean Sadler, former CTO of PlusNet, argues that the government needs to shift it’s focus to saving viable jobs – not just every job:

“The sad reality is, the furlough scheme had to come to an end. It was costing the government way too much money. We simply cannot afford to keep adding billions, and billions of pounds worth of debt on top of the lumped sum we are now stuck with.

“It’s time to shift our focus to more viable jobs – something the government should have done weeks ago – like software engineering, social care and researchers. The furlough scheme was too generalised – we need to see specific measures for specific industries, not a one-size-fits-all brushstroke. And as Rishi Sunak stated in his announcement, he “can’t save all businesses”, and nor should he. It’s time the government stopped generalising who’s at risk, and identify the businesses who can support our economic bounce back.”

Dame Carolyn Fairbairn, CBI Director-General, said:

Dame Carolyn Fairbairn, CBI Director-General, said:

“These bold steps from the Treasury will save hundreds of thousands of viable jobs this winter. It is right to target help on jobs with a future, but can only be part-time while demand remains flat. This is how skills and jobs can be preserved to enable a fast recovery.

“Wage support, tax deferrals and help for the self-employed will reduce the scarring effect of unnecessary job losses as the UK tackles the virus. Employers will apply the same spirit of creativity, seizing every opportunity to retrain and upskill their workers.

“The Chancellor has listened to evidence from business and acted decisively. It is this spirit of agility and collaboration that will help make 2021 a year of growth and renewal.”

Mike Cherry OBE, Federation of Small Businesses National Chair, said:

Mike Cherry OBE, Federation of Small Businesses National Chair, said:

“The UK’s small businesses are facing an incredibly difficult winter. Today’s support package is the flipside of the coin to Tuesday’s COVID-19 business restrictions.

“It is a swift and significant intervention, extending emergency SME loans, creating new wage support for small employers and the self-employed, and providing cashflow help on VAT deferrals and new Time To Pay for any tax bills to HMRC.

“We welcome that the Chancellor is ensuring that decisions to protect public health are informed by the need to protect the economy, people’s jobs and prospects for young people in our schools and workplaces.”

BCC Director General Adam Marshall said:

BCC Director General Adam Marshall said:

“The measures announced by the Chancellor will give business and the economy an important shot in the arm. Chambers of Commerce have consistently called for a new generation of support to help preserve livelihoods and ease the cash pressures faced by firms as they head into a challenging and uncertain winter.

“The Chancellor has responded to our concerns with substantial steps that will help companies preserve jobs and navigate through the coming months. The new wage support scheme will help many companies hold on to valued employees after furlough ends, and the extension of business lending schemes and tax forbearance will lessen the immediate pressure on cash flow for many affected firms.

“As we look past the immediate challenge, more will need to be done to rebuild and renew our economy. Chambers of Commerce across the UK will continue to work with government to ensure the benefits of these schemes are delivered to firms on the ground.”

Brian Berry, Chief Executive of the Federation of Master Builders (FMB), said:

Brian Berry, Chief Executive of the Federation of Master Builders (FMB), said:

“The Chancellor’s new Job Support Scheme comes at the right time and will help to protect construction jobs that might otherwise be at risk. We know that small builders’ workloads were severely impacted by the coronavirus lockdown, and growth since May has been sluggish. The critical test will be if homeowners can retain their confidence during this testing period.

“The greater flexibility in the Bounce Back Loan repayments and the deferred VAT payments are welcome. As any small business owner knows, cashflow is king, and these measures are essential in order to protect our precious SME construction firms from going into liquidation. If we are to ‘build, build, build’ our way to recovery, then we need these firms now more than ever.”

Kate Nicholls, CEO UK Hospitality, said:

“The extension of the VAT cut was absolutely critical and one that the industry was united in support for, so it is great to see the Government taking note of our major concerns about recovery into 2021. The announcement of longer tax deferrals and the option of longer loan repayments should deliver some much-needed breathing room for employers.

Things were looking grim for our sector yesterday and we were desperately hoping for some good news. The Chancellor has given us some reason to be positive again, and we look forward to engaging on specific measures to keep people in work and support our sector.”

Michelle Ovens MBE, Founder, Small Business Britain said:

“Small businesses are facing really tough challenges as we head into winter, so we are very pleased to see these new measures to help them through the uncertain time. I am pleased to see the Chancellor specifically direct the new Job Support Scheme to include all small businesses, and that other interventions like VAT bill extension, reduction extension for key sectors and easing the loan burden are designed with small businesses in mind. Small businesses remain at the heart of our economy and need all the help we can give them to endure this crisis, so they can go on to thrive again.”

Stephen Pegge, Managing Director of Commercial Finance at UK Finance, said:

“The banking and finance industry is providing unparalleled levels of support to businesses large and small to get them through these challenging times. Over 1.3 million businesses have so far received finance through the government-backed loan schemes, and lenders welcome the extension for applications to provide better co-ordination of end dates and allow time to consider what ongoing support is then required.

“These schemes are just one part of a broad package of measures from the industry, alongside commercial lending, capital repayment holidays, extended overdrafts and invoice finance facilities. UK Finance and its members will continue work with the government and other groups to ensure businesses are able to access the finance they need.”

Stephen Haddrill, Director General of the FLA, said:

“It’s good to see that the Chancellor has accepted our recommendation to extend CBILS, and we look forward to seeing what the successor scheme for 2021 will look like. We have already proposed a revised version of the Enterprise Finance Guarantee Scheme. What hasn’t been addressed in today’s announcement, and continues to be a challenge for our independent lenders, is access to funding that can then be deployed under the guarantee schemes. Our members are ready and willing to support SMEs, but they can’t do that without funds.”

CEO of techUK Julian David said:

“The support offered by the Chancellor today will be welcome news to anxious businesses, whilst also providing people with the support they need to take collective action to reduce the spread of the virus.

“While we look forward to the day when the Coronavirus is defeated, taking action now to prepare the UK for economic recovery and renewal will be vital for priming the country for what comes next.

“This means supporting businesses through difficult periods as the Chancellor has done today, but also working with industry to achieve the widespread uptake of digital technologies, encouraging retraining and reskilling for the jobs of the future and planning a green recovery which supports all the nations and regions of the UK.

“This will be a truly national effort and we look forward to playing our part alongside Government to achieve this.”

Stephen Kelly, Chair, Tech Nation, said:

“We welcome Rishi Sunak’s proactive and far-reaching programme of support for jobs and businesses to navigate the Covid-19 demand shockwaves. It signals a shift in gears by the Government towards targeted investment and a sustainable strategy and vision for Britain’s future.

“The new Job Support Scheme backs the growth of industries that are key to driving forward the new economy and providing more valuable jobs, growth and prosperity for the future. The Tech sector is at the heart of Britain’s future. In the two years before Covid-19, jobs across the digital tech sector increased by 40% and the industry now employs three million people, accounting for almost 10% of the UK’s workforce and contributing £186bn to the economy. Pre-Covid-19, the tech sector was growing six times faster than the rest of the economy. The UK has embraced digital to manage through the crisis.

“The tech sector plays a critical role in the UK’s future, and the Government’s funding measures announced today demonstrate their commitment to accelerating this new economy with Digital at the heart of its Vision for Britain.”

Dom Hallas, Executive Director, The Coalition for a Digital Economy (Coadec) said:

“The Future Fund has been a huge success with over £1.4bn of public and private investment delivered so far. It’s given hundreds of innovative British startups the ability to survive through the crisis and thrive after and we’re delighted to see the Chancellor extend the scheme to ensure that as many startups as possible are able to get the investment they need.”

Michael Moore, Director General, British Private Equity and Venture Capital Association said:

“The new measures announced by the Chancellor will provide much needed reassurance to businesses and workers across the country as we continue to respond to the impact of COVID-19. The Job Support Scheme will enhance the livelihoods of many hard-working people who will be able to work short hours with government support. We also welcome the extension of the Future Fund and CBILS schemes. This will undoubtedly help businesses plan for the winter and the subsequent recovery.”

Stephen Phipson, Chief Executive, Make UK said:

“I warmly congratulate the Chancellor for taking decisive action that will help avoid the significant redundancies we were facing had there been a cliff edge end to government support. The priority right now has to be saving as many jobs as possible and this is a bold and brave move which industry will welcome. In particular, the Chancellor should take great credit for reflecting on the experience of other countries and implementing similar measures here; this will help us be strongly competitive as we return to normal trading conditions.

“Building on this, we must also recognise that there are some sectors of manufacturing where there is still not enough demand to even drive part time work. These are viable, often world leading firms, facing a sustained but temporary absence of demand. The aerospace and automotive sectors in particular, along with their supply chains, are leading edge high skill areas which will be the growth sectors of the future.

“I know that the Chancellor shares our concerns and we look forward to discussing what further measures can be brought forward to support these vital sectors for our economy which will be the engines of our future economic success.”

Irene Graham OBE, CEO, ScaleUp Institute said:

“We are pleased that the Chancellor is evolving his support to businesses through the coming months. The Job Support Scheme and extension of finance options, including Pay as You Grow, will be welcomed by many innovative and scaling companies, across the country, who will play such a central part in the UK’s economic recovery.”

Gerry Keaney, Chief Executive, British Vehicle Rental and Leasing Association, said

“Businesses most affected by the pandemic need all the help they can get right now and we welcome the Chancellor’s decision to extend financial support beyond October. Our latest Covid Survey shows that 37% of BVRLA members expect to have employees still on furlough at the end of October, so this additional support will help to stem potential job loss. Our industry is resilient and continues to adapt ways of working to protect lives and livelihoods, but cash is king when it comes to survival and this additional support will provide a lifeline for many organisations that are battling to maintain a sustainable business and protect jobs.”

The package of measures, which applies to all regions and nations of the UK, includes:

Support for workers

A new Job Support Scheme will be introduced from 1 November to protect viable jobs in businesses who are facing lower demand over the winter months due to coronavirus.

Under the scheme, which will run for six months and help keep employees attached to the workforce, the government will contribute towards the wages of employees who are working fewer than normal hours due to decreased demand.

Employers will continue to pay the wages of staff for the hours they work – but for the hours not worked, the government and the employer will each pay one third of their equivalent salary.

This means employees who can only go back to work on shorter time will still be paid two thirds of the hours for those hours they can’t work

In order to support only viable jobs, employees must be working at least 33% of their usual hours. The level of grant will be calculated based on employee’s usual salary, capped at £697.92 per month.

The Job Support Scheme will be open to businesses across the UK even if they have not previously used the furlough scheme, with further guidance being published in due course.

It is designed to sit alongside the Jobs Retention Bonus and could be worth over 60% of average wages of workers who have been furloughed – and are kept on until the start of February 2021. Businesses can benefit from both schemes in order to help protect jobs.

In addition, the Government is continuing its support for millions of self-employed individuals by extending the Self Employment Income Support Scheme Grant (SEISS). An initial taxable grant will be provided to those who are currently eligible for SEISS and are continuing to actively trade but face reduced demand due to coronavirus. The initial lump sum will cover three months’ worth of profits for the period from November to the end of January next year. This is worth 20% of average monthly profits, up to a total of £1,875.

An additional second grant, which may be adjusted to respond to changing circumstances, will be available for self-employed individuals to cover the period from February 2021 to the end of April – ensuring our support continues right through to next year.

This is in addition to the more than £13 billion of support already provided for over 2.6 million self-employed individuals through the first two stages of the Self Employment Income Support Scheme – one of the most generous in the world.

Tax cuts and deferrals

As part of the package, the government also announced it will extend the temporary 15% VAT cut for the tourism and hospitality sectors to the end of March next year. This will give businesses in the sector – which has been severely impacted by the pandemic – the confidence to maintain staff as they adapt to a new trading environment.

In addition, up to half a million business who deferred their VAT bills will be given more breathing space through the New Payment Scheme, which gives them the option to pay back in smaller instalments. Rather than paying a lump sum in full at the end March next year, they will be able to make 11 smaller interest-free payments during the 2021-22 financial year.

On top of this, around11 million self-assessment taxpayers will be able to benefit from a separate additional 12-month extension from HMRC on the “Time to Pay” self-service facility, meaning payments deferred from July 2020, and those due in January 2021, will now not need to be paid until January 2022.

Giving businesses flexibility to pay back loans

The burden will be lifted on more than a million businesses who took out a Bounce Back Loan through a new Pay as You Grow flexible repayment system. This will provide flexibility for firms repaying a Bounce Back Loan.

This includes extending the length of the loan from six years to ten, which will cut monthly repayments by nearly half. Interest-only periods of up to six months and payment holidays will also be available to businesses. These measures will further protect jobs by helping businesses recover from the pandemic.

We also intend to give Coronavirus Business Interruption Loan Scheme lenders the ability to extend the length of loans from a maximum of six years to ten years if it will help businesses to repay the loan.

In addition, the Chancellor also announced he would be extending applications for the government’s coronavirus loan schemes that are helping over a million businesses until the end of November. As a result, more businesses will now be able to benefit from the Coronavirus Business Interruption Loan Scheme, the Coronavirus Large Business Interruption Loan Scheme, the Bounce Back Loan Scheme and the Future Fund. This change aligns all the end dates of these schemes, ensuring that there is further support in place for those firms who need it.

Investment in public services

At the start of the pandemic, the Chancellor pledged to give the NHS and public services the support needed to respond to coronavirus – and as of today, £68.7 billion of additional funding has been approved by the Treasury, including £24.3 billion since the Summer Economic Update in July.

This funding has helped ensure the procurement of PPE for frontline staff, provided free school meals for children while at home and protected the country’s most vulnerable. In addition, the £12 billion funding to roll-out the Test and Trace programme has played a key role helping to unlock the economy, enabling businesses like restaurants and bars to serve customers again.

As announced earlier this year, the Treasury has also guaranteed the devolved administrations will receive at least £12.7 billion in additional funding. This gives Scotland, Wales and Northern Ireland the budget certainty to for coronavirus response in the months ahead.

Read Rishi’s WINTER ECONOMY PLAN Statement in full here.

Responses