Which Sectors Have Seen the Biggest Declines and Increases in Job Vacancies?

Shedding Light on the Labour Market #LMI

This is the first in a regular fortnightly series from Emsi, the Labour Market Insight specialists, whereby they take a look at interesting trends and developments in the labour market, particularly those that are directly connected with the ongoing disruption in the economy.

In a recent article, we looked at the Office for National Statistics’ Job Vacancies by Industry figures, which is a helpful way of understanding which sectors have been most effected by the crisis, and where recovery is happening.

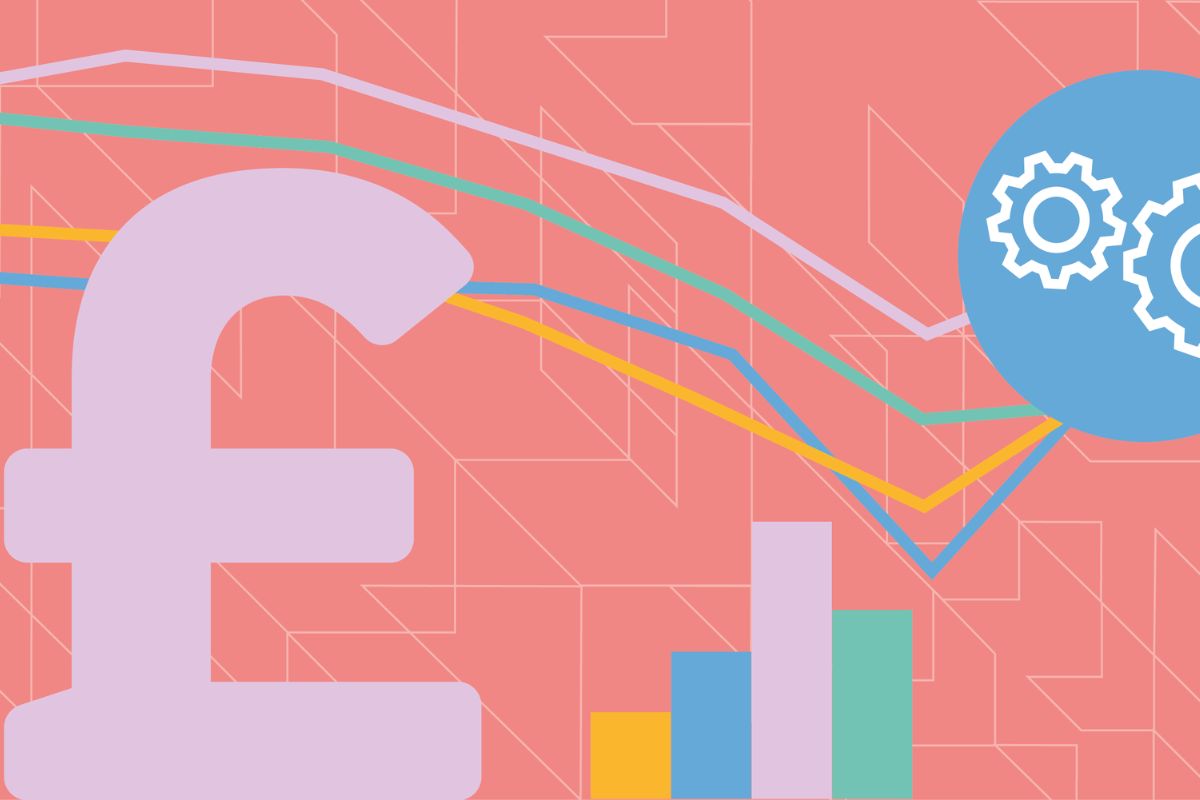

What we saw in those figures was that job vacancies – defined as “positions for which employers are actively seeking to recruit outside their business or organisation” and published on a three-month rolling average – had fallen dramatically at the start of the crisis, declining from 796,000 vacancies in the period January-March, to 341,000 in April-June – a fall of over 57%.

However, the figures from May-July then offered a glimmer of hope, with an uptick of 36,000 to 377,000 job vacancies throughout the country.

15% Increase In Vacancies

The latest figures, covering the period June-August, have now been released, and the first thing to say is that they again show an increase in vacancies.

Across all sectors, there are now 434,000 vacancies, which is an increase of 15.1% on the previous three-month rolling average, and 27.1% from the low point in April-June.

In terms of actual sectors, we have produced an interactive chart below, showing job vacancies since 2015, which allows you to take a closer look at specific sectors by clicking on the buttons at the top of the chart:

So what are the main points being shown by the data?

The downturn is very much evident across all sectors without exception, although some industries have clearly been much harder hit than others. For instance, Accommodation and food services has been particularly hard hit by the near total shutdown of the sector for over two months, with the number of vacancies declining from around 90,000 at the beginning of the year to just 8,000 in April-June, although this has now risen to around 27,000 in June-August. Wholesale and retail is another sector that saw a big decline, falling from around 130,000 vacancies at the beginning of the year, to 39,000 in April-Jun, although again the industry has now seen an increase, such that in June-August there were 51,000 vacancies – still a long way off business as usual, but certainly an improvement.

Of all the sectors, perhaps the most interesting trend is that for Financial and insurance activities. At the beginning of the year, there were around 30,000 job vacancies in this industry, and like all other sectors there was then a big decline, in this case down to 18,000 in April-June. However, unlike all other sectors, which have since then either seen an increase or at least remaining at the April-June level, vacancies for Financial and insurance activities have continued to decline, falling to just 16,000 in June-August. This will definitely be one to keep an eye on when we look at the next set of data for July-September, which is due for release in mid-October.

Watch out for the next piece in this regular series on 7th October.

To find out more about how the crisis is affecting your local area, contact Emsi for more info.

Responses