Labour Market Overview: Unemployment Rate Rises to 4.3%

- The employment rate (ages 16-64) is at 74.8% in July-September 2024

- The unemployment rate (ages 16+) is at 4.3% and has increased both quarterly and annually

- Economic inactivity rate (ages 16-64) is at 21.8% and has decreased from the previous year

- Vacancies are declining but still above pre-pandemic levels at 831,000 openings

- Regular wages are growing at 4.8% (excluding bonuses), with real terms growth (adjusted for inflation) at 1.9%

- Total payrolled employment is at 30.4 million, showing small monthly decreases but annual growth

Latest Data

Estimates for payrolled employees in the UK decreased by 9,000 (0.0%) between August and September 2024, but rose by 136,000 (0.4%) between September 2023 and September 2024.

Payrolled employees fell by 9,000 (0.0%) over the quarter but rose by 182,000 (0.6%) over the year, when looking at July to September 2024, which is the period comparable with our Labour Force Survey (LFS) estimates.

The early estimate of payrolled employees for October 2024 decreased by 5,000 (0.0%) on the month but increased by 95,000 (0.3%) on the year, to 30.4 million. The October 2024 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month.

Increased volatility of LFS estimates, resulting from smaller achieved sample sizes, means that estimates of change should be treated with additional caution. We recommend using them as part of our suite of labour market indicators, alongside Workforce Jobs (WFJ), Claimant Count data, and Pay As You Earn (PAYE) Real Time Information (RTI) estimates.

The UK employment rate for people aged 16 to 64 years was estimated at 74.8% in July to September 2024. This is largely unchanged on a year ago, but up in the latest quarter.

The UK unemployment rate for people aged 16 years and over was estimated at 4.3% in July to September 2024. This is above estimates of a year ago, and up in the latest quarter.

The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.8% in July to September 2024. This is below estimates of a year ago, and down in the latest quarter.

The UK Claimant Count for October 2024 increased both on the month and on the year, to 1.806 million.

The estimated number of vacancies in the UK decreased in August to October 2024, by 35,000 on the quarter to 831,000. Vacancies decreased on the quarter for the 28th consecutive period but are still above pre-coronavirus (COVID-19) pandemic levels.

Annual growth in employees’ average regular earnings excluding bonuses in Great Britain was 4.8% in July to September 2024, and annual growth in total earnings including bonuses was 4.3%. This total annual growth is affected by the civil service one-off payments made in July and August 2023.

Annual growth in real terms, adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH) for regular pay was 1.9% in July to September 2024, and for total pay was 1.4%.

There were an estimated 48,000 working days lost because of labour disputes across the UK in September 2024.

Latest indicators at a glance

Trends and considerations around comparisons

In this section, we supply additional commentary to help users assess the different sources of data we publish on employment and related indicators.

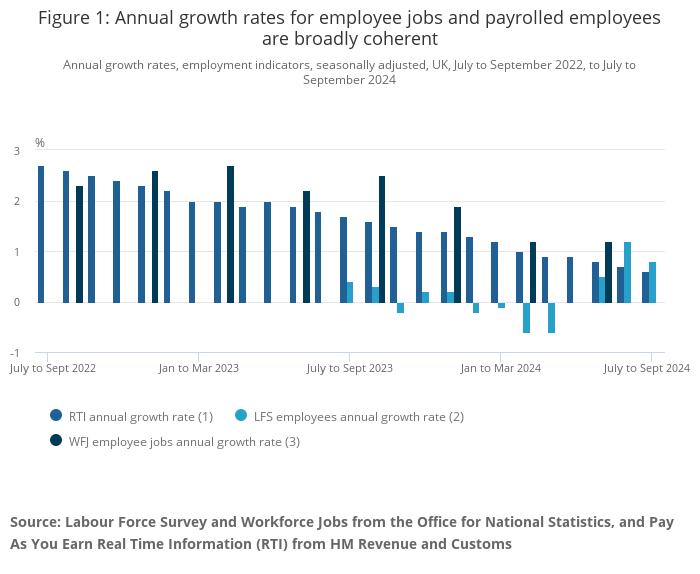

Figure 1 shows the annual growth rates in a selection of our different employment indicators, with annual growth rates giving a more stable, longer-term view on changes. The Labour Force Survey (LFS) is our survey of households, while Workforce Jobs (WFJ) is based predominantly on business surveys for employee jobs, with the LFS covering self-employed jobs. HM Revenue and Customs’ Pay As You Earn (PAYE) Real Time Indicators (RTI) data are derived from administrative tax records and covers only payrolled employees.

Each of these sources are collected and processed in different ways so we do expect differences in levels, for example, jobs versus people, while divergent trends between individual periods are also possible.

There have been ongoing challenges in assessing the coherence between these statistics as we have described in recent months. For the datasets available in the latest period, annual growth ranges from 0.6% for payrolled employees up to 0.8% for LFS employees. Though this is relatively coherent for this specific point in time, observing over a longer time period shows differing trends in annual growth rates. Annual growth in the latest measures from RTI and WFJ have continued to slow, while LFS is showing a different picture.

As outlined in previous Labour market overviews, the longer-term broad coherence between RTI and WFJ, when looking at annual change, suggests that these sources are likely to be providing a more reliable estimate of employment, particularly for employees. These sources continue to indicate that we have seen a sustained moderation of growth in employment over the last year. RTI and WFJ also show less volatility than the LFS over the same time period.

Despite these coherence challenges, the LFS continues to be the sole source of data for unemployment, economic inactivity and the self-employed. There are also a range of breakdowns that are only possible from LFS data.

As external sources are suggesting that recent increases in LFS measures of employment are likely to be overstating underlying employment growth, we expect that underlying changes in the other labour market statuses will also be affected. For example, the more modest growth we see in alternative employment sources may indicate that unemployment and economic inactivity may have moved less than the LFS has recently suggested.

It is also likely that some of the recent movements in LFS estimates are being affected by the increased sample size and change in data collection methods introduced over the last year, in addition to any underlying changes in the labour market.

The wave structure of the LFS means that any changes in sampling can take a substantial period of time to fully feed through the survey. We interview sampled households at quarterly intervals for five consecutive quarters. Any given three-month dataset includes respondents completing their first, second, third, fourth or fifth interview (often called “waves”).

Between July and December 2023, the Wave 1 sample for the LFS was reduced to its pre-coronavirus level, before the boost was reinstated from January 2024. This reduction in the sample stays in our LFS datasets for five quarters, as these smaller cohorts progress through subsequent waves, all the way to Wave 5. From July 2024, the smaller cohorts are steadily being replaced by boosted cohorts. However, it will not be until the January to March 2025 period (published in May 2025) when LFS data only include boosted cohorts.

We are continuing to improve the quality of the LFS, building on our work to date. This has led to an increase in achieved interviews, from 44,238 in July to September 2023 to 59,139 in July to September 2024, as shown in our LFS performance and quality monitoring report: July to September 2024. Work is also under way to carry out a further reweighting of our LFS estimates, detailed in our Labour market transformation article. An Impact of reweighting on Labour Force Survey key indicators article will be published on 3 December 2024, and the reweighted estimates will be incorporated into our next Labour market release on 17 December 2024, which we anticipate will improve coherence between LFS and other sources. With this work ongoing, we advise caution particularly when interpreting short-term change in the LFS and encourage users to make use of a wide range of data sources where possible.

Sector Reaction

Work and Pensions Secretary, Liz Kendall MP said:

“2.8 million people – a near record number are locked out of work due to poor health. This is bad for people, bad for businesses and it’s holding our economy back.

“That’s why our Get Britain Working plan will bring forward the biggest reforms to employment support in a generation, backed by an additional £240m of investment.

“And while it’s encouraging to see real pay growth this month, more needs to be done to improve living standards too. So, from April next year over three million of the lowest paid workers will benefit from our increase to the National Living Wage, delivering a £1,400 a year pay rise for a full-time worker.”

Matthew Percival, Future of Work and Skills Director, CBI, said:

“The labour market continues to split with signs of employers’ weakening intentions to hire at the same time as a welcome fall in inactivity. These figures come against a backdrop of rising concern about spiralling employment costs which are set to increase following last month’s National Insurance Contribution (NICs) rise, the Employment Rights Bill and the latest increase in the National Living Wage.

“Over the coming months, it will be key for the government to work with business to ensure that these costs are manageable. When margins are squeezed too far, employers lose the headroom to pursue growth and a growing number are facing difficult decisions between cutting either investment or jobs.”

The Recruitment and Employment Confederation (REC) Chief Executive Neil Carberry said:

“Today’s labour market statistics confirm the cooling trend on pay and vacancies suggested by the business surveys. This shows that the Bank of England is right to go for a period of rate cuts as pay pressures have eased and growth needs to be the focus.

“Going for growth also means boosting business investment. Many businesses will be feeling bruised by the large increases to their employment costs in the Budget and Employment Rights Bill. Getting growth going is what makes changes more affordable, that’s why firms will be looking for real change on industrial strategy, public service reform and skills.

“The stable picture on temporary workers emphasises again how important flexible working is for workers and companies alike when things are uncertain. From keeping the NHS on its feet to helping people find their first steps in work, government needs to embrace the many ways in which people work today if it is to be successful. Backing temporary workers matters to our economy – but most of all to the temps themselves.”

TUC General Secretary Paul Nowak said:

“Labour’s budget took some vital first steps to repair the economic damage left by the Tories – stronger growth is an essential starting point for more jobs and higher pay. The government’s plan to Get Britain Working must now focus on supporting young people out of long-term unemployment.

“With long-term youth unemployment now at a post-pandemic high and still rising, young people urgently need genuine opportunities to work or engage in training. Acting now can set young people up for a better future.

“The Get Britain Working white paper will also be an important opportunity to provide life-changing health and employment support to people who are economically inactive because of ill health, but who desperately want to work again.”

Commenting on zero-hours contracts, Paul Nowak said:

“Everyone deserves a decent, secure job that they can build a life on.

“But over a million workers are trapped on zero-hours contracts that offer them little or no security – not knowing how much they will earn from one week to the next and unable to plan budgets or childcare.

“A crackdown on these exploitative zero-hours contracts is long overdue.

“Labour’s Employment Rights Bill is a decisive step towards tackling the scourge of insecure work.

“All working people should have a right to a contract that reflects their regular hours of work and reasonable notice of shifts.”

Ben Harrison, Director of the Work Foundation at Lancaster University, said:

“While employment levels are stable, this masks that key indicators such as vacancies, wages and long-term sickness are stuck in reverse.

“Vacancies have decreased for the 28th consecutive month but remain 35,000 above pre-pandemic levels. With recent hikes to employer National Insurance contributions and the minimum wage soon to take effect, we could see further cooling of the jobs market as some employers will lack confidence to employ more people as their overheads rise.

“Wage growth is continuing to soften from the highs of 2023, but the UK is still in the midst of a 16-month period of positive real pay growth. However, this comes on the back of more than a decade of pay stagnation since the Global Financial Crash in 2008, and with staff demand falling and inflation due to rise over the coming months, the good news may be short-lived.

“If the UK Government is to meet its intended 80% employment rate, it must act to address the high levels of long-term sickness that are keeping too many people out of the jobs market. Despite unemployment being at historically low levels, the UK has had over 2.7 million people out of the labour market due to long-term sickness since May-July 2023.

“Taken together, the forthcoming Get Britain Working White Paper and Employment Rights Bill represent a big opportunity to support more people into sustained and secure employment – but only if the Government sticks to its guns on the direction and strength of reforms.

“The emphasis must be on de-risking remaining in and returning to work for those with long-term health conditions. That means strengthening the UK’s meagre statutory sick pay system that forces some to work while ill, boosting access to flexible working from day one of employment, and shifting the focus of the welfare system away from punitive sanctions and towards more tailored, long-term employment support.”

Isaac Stell, Investment Manager at Wealth Club said:

“A pickup in the unemployment rate may start to ring alarm bells in the halls of Westminster as the rate for September exceeded expectations by some margin. This increase serves as a warning sign to the Government following on from the Budget where businesses saw a large increase in the level of national insurance contributions they will have to pay. If these additional costs restrict hiring and cause jobs to be lost, its so-called growth agenda will be further scrutinised.

Despite the uptick in the unemployment rate, wage growth came in hotter than expected, causing a conundrum for the Bank of England. Cut rates and higher wage growth may lead to a reacceleration in inflation. Hold rates and the restrictive conditions may put further pressure on already struggling businesses.”

Dr Andrea Barry, Principal Economist at Youth Futures Foundation, comments:

“Today’s ONS Labour Market statistics indicate a persistent issue of youth unemployment, with 13.6% of 16-24-year-olds outside of full-time education who are unemployed, and a further 20.3% economically inactive.

“The rise in economic inactivity among young people over the past year is a key cause for concern, and these figures highlight the need for targeted interventions to address the challenges faced by young people in our labour market.

“There needs to be determined policy focus on this challenge. Young people must be at the heart of the development of initiatives such as Make Work Pay, Get Britain Working, and the Growth and Skills Levy, in order to create a more inclusive and brighter future for all.”

Responses