House prices 25% higher in top university cities may be stifling #talent

This is how much Top Universities impact rent prices in Student Cities

House prices in top university cities around the world are on average 25% higher than the national average according to recent analysis.

The analysis looked at the residential property markets of the top 50 University cities around the world, and determined that house prices grew on average 65.8%, compared to a national average growth of 40%.

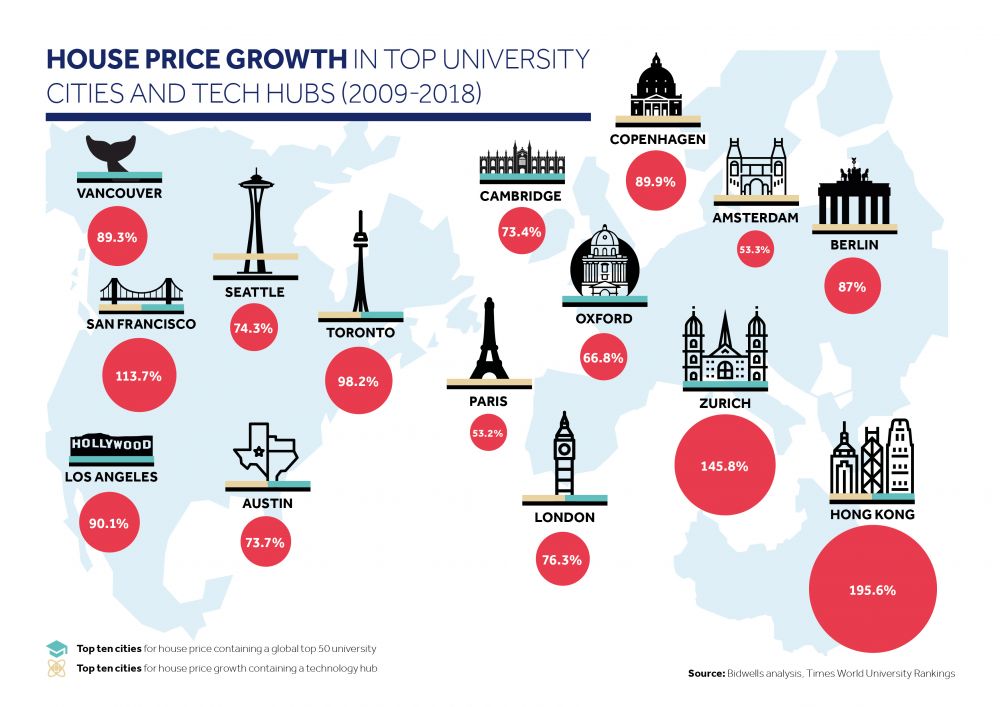

Top 50 university cities Hong Kong, Zurich, San Francisco, Toronto and Los Angeles saw the highest growth, with Oxford, Cambridge and London all in the top 10.

Bidwells has produced the research to encourage joined up thinking about housing and economic growth and draw attention to Oxford and Cambridge, home to the world’s two highest ranked universities, and which have seen house price growth of 66.8% and 73.4% respectively, while London sits just above at 76.3%.

With supply in Oxford and Cambridge in particularly constrained, house prices look set to continue to rise, which may stifle economic growth as talent finds it more difficult to remain in the cities post-degree, despite the burgeoning science & tech sectors currently spinning out billions of pounds of AI start-ups in the area.

While flourishing universities or tech scenes are themselves only part of house price growth, they are one of a number of factors that drive a successful global city’s economy.

Certain US ‘tech cities’ with strong universities but restricted housing supplies have seen disproportionately large increase in house prices as young millennials flood into cities for work, particularly on its west coast.

Patrick McMahon, Senior Partner at Bidwells, said:

“The downside of a booming global city is that house prices in many of those hubs are becoming so high – due to inflation and migration for work – that there is risk of curtailing growth or even a decline in the quality of life, especially in smaller markets with very limited supply. Bidwells has conducted this research to show what might happen to Oxford and Cambridge if we don’t start taking infrastructure and housing provision seriously.

“Oxford and Cambridge are small cities who find themselves on the global stage off the back of their world-class universities and we do not want unaffordable housing to stifle further economic growth, or to put off the next wave of global businesses locating in these cities because they cannot attract long-term workers. We need to start planning now.”

Headline house price growth in Universities (%)

|

2009-18 |

|

|

All countries |

40.5% |

|

Top 50 uni cities |

65.8% |

|

Top ten highest price growth cities home to a global top 50 university |

||

|

% increase 09-18 |

Uni ranking |

|

|

Hong Kong |

195.6 |

36 |

|

Zurich |

145.8 |

11 |

|

San Fran |

113.7 |

3 |

|

Toronto |

98.2 |

21 |

|

LA |

90.1 |

5 |

|

Vancouver |

89.3 |

37 |

|

London |

76.3 |

14 |

|

Austin |

73.7 |

39 |

|

Cambridge |

73.4 |

2 |

|

Oxford |

66.8 |

1 |

As venture capital increasingly looks to top universities as the potential source for a future Google, SpaceX or AstraZenica, skilled talent has flocked to these locations contributing to house price growth.

The rapid growth in house prices is starting to provoke drastic solutions to curtail growth – from both governments and the private sector.

Bidwells has set out a number of methods that could ease the affordable housing crisis in Cambridge and Oxford:

- Allocations in local plans for key worker housing in the affordable mix

- Designated funding from Homes England to aid development of affordable and key worker homes

- Encouraging science park and other business space providers to look at live/work models

- Tie ups with big businesses to provide cheaper loans for housing in return for tax breaks

- Encouraging higher density development in sustainable locations e.g.next to transport hubs

Responses